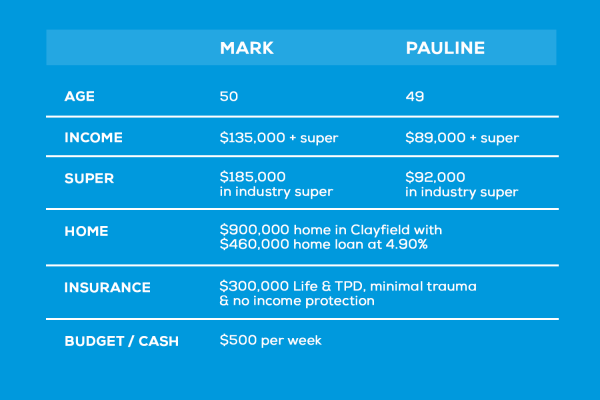

My Wealth Solutions is an award-winning Financial Advice firm that has been helping families create financial success for over 10 years. Our experienced advisors are experts in investing, property, and wealth creation strategies to help our clients create a secure financial future. Read the success stories of Mark & Pauline > or Jack & Lucinda > for real-world results.

Most people never take action and never realise the opportunities they have missed. Every day that goes by can take you further away or closer to your goals. If you have built equity in your home that you haven’t put to use, you aren’t sure what your next step is, or maybe you want to outsource the financial labour, this is your sign to take that next step.

Claim your free consultation today and learn how we will help you succeed while taking the stress out of your finances.

“Now I have an investment property…”

“Now I have an investment property…”