Our Investment Philosophy

A flexible and intelligent investment approach tailored to your portfolio

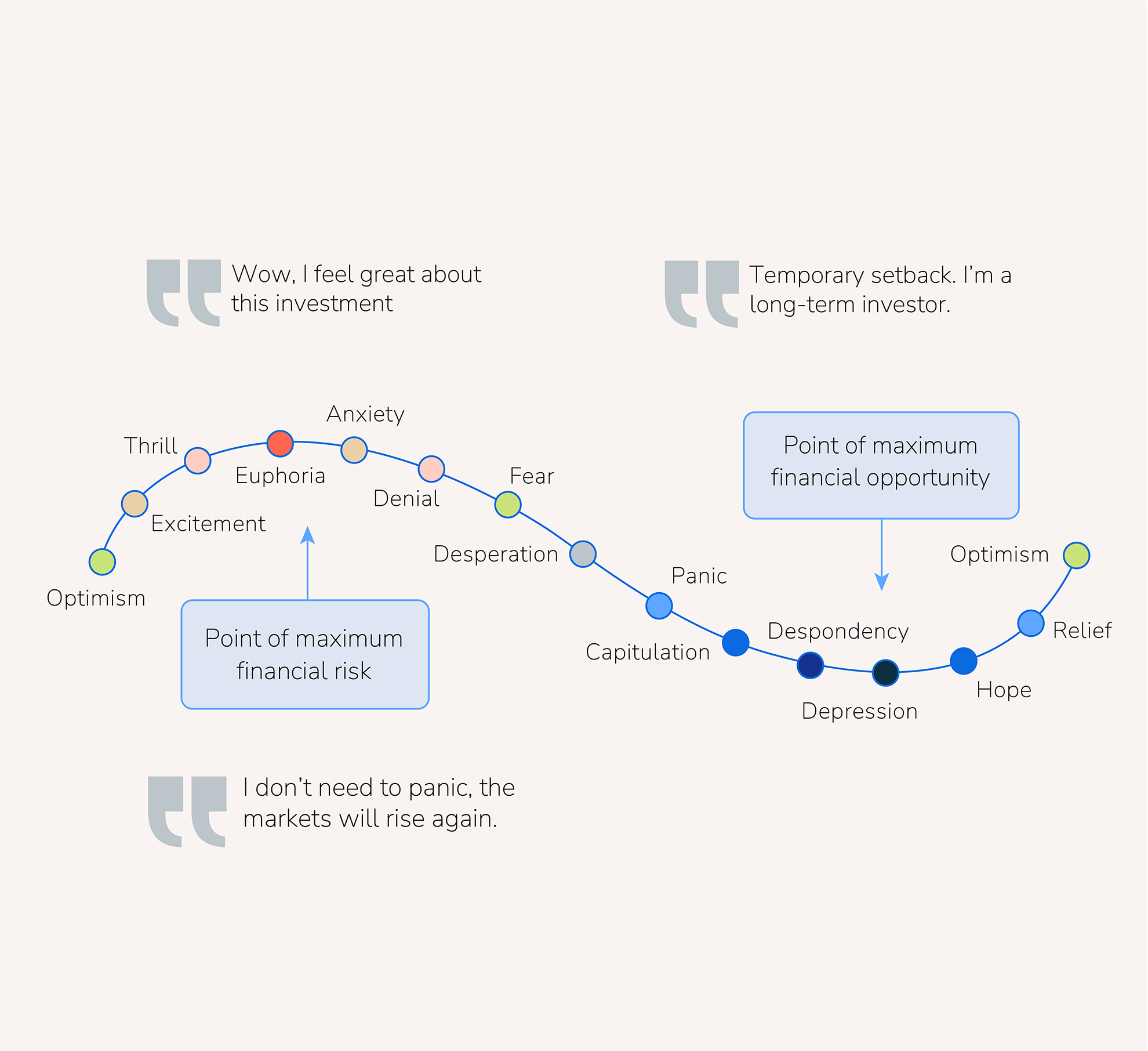

The CAREphilosophy® is designed to work in the real world for people with a variety of portfolio goals and risk profiles. While traditional investment theories are focused on asset selection, with a minor emphasis on market timing, the CARE Philosophy is designed to also absorb the risks posed by investor behaviour.

The CAREphilosophy® is based on the principle that investor behaviour makes the difference in your investment success. Traditional investment theories are focused on where assets are allocated, with a minor emphasis on market timing and selection. The CAREphilosophy®, on the other hand, is made up of three key areas: investor behaviour makes up 50% of this; asset allocation 45%, and timing and selection 5%.

Currently, there is over $1,005 million invested utilising the CARE Investment Philosophy, with individual portfolios varying from $60,000 to $15 million.

45% of your returns come from your portfolio structure – not from timing the market or carefully hand-selecting your stock picks. CARE puts this insight into practice, with a strategy that focuses on asset allocations that suit your goals and timeline, a bucket structure to ensure you are diversified and well-protected, and a Money on the Move function that allows you to make the most of market changes.Around 50% of your returns are impacted by your behaviour. That’s why CARE aims to prevent bad investment decisions destroying the wealth you’ve worked hard to create.