When it comes to growing your wealth and securing a brighter financial future, it’s likely you’ve heard about the importance of turning bad debt into good debt. The strategy known as debt recycling, or mortgage recycling, is one way you can successfully do this.

But what exactly is the difference between good and bad debt and how can debt recycling help you turn one into the other?

This guide will explain:

- The Difference in Bad Debt vs Good Debt

- What Is Debt Recycling

- The Benefits of Debt Recycling

- The Downsides of Debt Recycling

- How Debt Recycling Can Help You

Or if you’d like to find out more about how debt recycling may apply to your specific financial situation, you can talk to an investment advisor.

Key Takeaways

- Debt recycling involves ‘replacing’ your bad (non-deductible) debt with good (tax-deductible) debt

- The strategy can be extremely powerful to use your money more effectively, but it comes with risks, so you should always seek advice.

What Is Debt Recycling?

Debt recycling is a way to turn your existing bad debt, such as your mortgage, into good debt that is tax deductible.

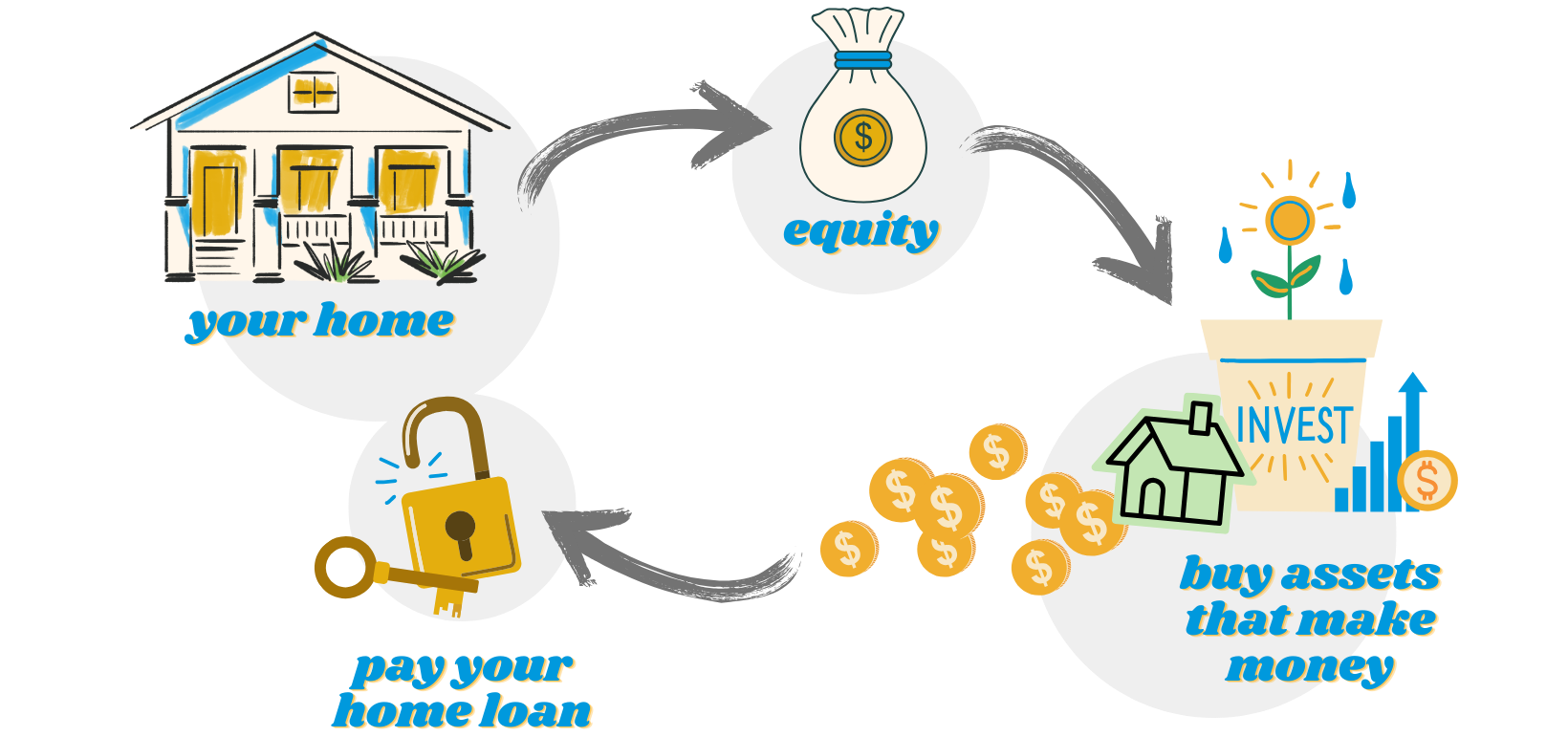

Debt recycling, at its most basic form, involves leveraging the equity in your non-tax-deductible asset, i.e. your mortgage, to invest in an income-producing asset (which you can claim a tax-deduction on). You then use that income to pay off your home loan. Once your home loan is paid off, you only have the tax-deductible loan on your investment assets to pay.

Look, I know it can sound complicated! Keep reading, as we’ll explain everything in this comprehensive guide.

Bad Debt vs Good Debt

We define good debt as a debt that is tax-deductible, or is owing on a nest egg asset which is helping you grow your long-term wealth. Bad debt, on the other hand, is any that is not tax-deductible and/or is not owed on an asset that is helping you grow your wealth.

Common examples of bad debt include car loans, credit card debt and even the mortgage on your principal place of residence. Yes, that’s right, while owning a home can have a number of financial benefits, your mortgage may actually be considered bad debt! This is because, even though you’re paying off an asset, you’re not getting any income or tax benefits out of that money in the meantime.

That’s where debt recycling comes in.

How Debt Recycling Works

This is an example of debt recycling. You’re paying off your mortgage and realise that you’ve built an equity in your home of $300,000. You draw out some of that equity and invest it into a rental property or shares – some kind of income-producing asset. The interest on the investment loan to purchase the income-producing asset is tax-deductible. And now you use the tax savings and investment income to pay down your outstanding home loan balance more quickly.

If you simply invest rather than ‘recycling’ your debt on your home loan, you won’t receive the tax benefits of the income-producing asset. This is because you now have a tax deduction – where before, you didn’t.

Now it’s important to realise that you’re not actually ‘increasing’ your debt. As you continue to pay off your home loan, you can draw that money out to invest. You are then creating multiple assets, one of which is producing income that helps to offset the costs of the other.

More importantly, you are able to use that income to pay off your non-deductible loan more quickly. Typically, you’ll see the non-deductible home loan shrink over time, while your ‘tax-deductible investment loan’ grows. The idea is to keep recycling your debt until you have effectively moved all your debt into a tax-deductible position.

Now you might wonder why you don’t just invest, without drawing out your equity to do so? Great question – simply put, if you do that you won’t access the tax savings on the interest. And these savings can be very significant over time. Debt recycling can particularly benefit those with a high income who may otherwise end up paying more in tax.

Here’s a video from our licensee company, GPS Wealth, to help you understand what debt recycling looks like in action:

Since you will end up with two loans during this process, both of which will likely be leveraged against your principal place of residence, you need to be comfortable and confident you are able to keep paying your loans.

While using a debt recycling strategy can help you amplify the benefits of investing and build your wealth in a quicker and more efficient way, it also amplifies the risks you may encounter if there is a market turndown.

Determining whether debt recycling is the right strategy for you will depend on your risk tolerance, the time until you need to access your investment assets and your short, medium and long-term financial goals.

When we approach this strategy with our clients, we carefully evaluate each element of your financial situation to ensure that debt recycling is the right fit for you and your unique financial circumstances, and that it will achieve what you want it to.

The Benefits of Debt Recycling

In a nutshell, when debt recycling is done right, you’ll have the benefits of

- Owning your home sooner

- Saving on tax

- Building & diversifying your investments (and your wealth)

- Not sacrificing your current lifestyle while getting better results

Just like many financial strategies, debt recycling can have different benefits depending on your particular financial situation, income and future financial goals. One of the most important benefits of debt recycling is that it helps you build an investment portfolio and grow wealth faster.

In the traditional route, you would pay off the mortgage on your family home first before building an investment portfolio. But, that means that you are sacrificing the compounding returns you would have gained had you started building your investment portfolio earlier. When you consider that it takes 25-30 years for the average family to pay off their mortgage, the returns you potentially miss out on over that time will have a significant impact on the likelihood of you achieving other financial goals – or building wealth for retirement.

Debt recycling also has considerable tax benefits which are especially useful for high-income earners. Since this strategy is geared primarily around minimising your tax obligations and maximising your tax benefits, debt recycling may turn out to be more cost-effective than if you hadn’t undertaken any strategy at all. The higher your marginal tax rate, the more profitable this strategy could be for you.

Finally, utilising a debt recycling strategy can allow you to build a diverse investment portfolio from the beginning. While a more traditional investment strategy would lock you into one type of investment – for example property – until it was completely paid off, debt recycling can be used to free up extra money that can then be used to invest in shares or other diverse investment assets such as investment properties. This way you not only gain the benefits of compounding returns but also ensure that your wealth is spread across multiple asset types and sectors as it continues to grow, thus protecting it from market downturns when they occur.

The Downsides of Debt Recycling

While debt recycling does have a number of benefits, there are a few downsides worth considering – especially if your strategy is not structured correctly or you don’t have the required income to support the endeavour over the long term.

The number one thing you should know before considering debt recycling is that just as your returns are compounded, so too are any losses you might suffer when markets experience a downturn. Since you have debt owing on two types of investment assets, when the market experiences a turn it’s highly likely you will feel it on both sides.

In most debt recycling strategies, the asset that your strategy is leveraged against is your family home. You have to be comfortable with the level of risk associated with this strategy.

It is also due to this increased risk factor that we usually only recommend debt recycling as a longer-term strategy. This allows you time to recover from any market dips that might occur, before you have the need to draw out the income from your assets. In fact, we usually like to start with an investment timeframe starting at 7 years, with a longer time frame generally leading to better benefits.

Debt recycling is most effective for those with a secure income, who will be able to comfortably service both loans (and who’ll benefit the most from the tax advantages). However, depending on the situation, we also use the strategy successfully with clients who are looking to purchase their first investment property using the equity in their home.

If you are able to tick the financial boxes, it’s also important that you have a sufficient amount of personal protection to ensure you or your loved ones are able to continue meeting your loan repayments in case something unexpected happens. You can also speak to a financial advisor about what insurances are recommended in these situations.

Is Debt Recycling Worth It?

Whether it is worth it for you depends on how this technique will affect your current financial situation and your future investment goals.

Before building a debt-recycling strategy on your own, we highly recommend speaking to a financial professional who has experience in this area. This is because your situation can really impact how successful you will be in using the strategy. And you need to know what the outcomes might be in order to 1) protect yourself, and 2) achieve the financial security you desire.

However, as we’ve covered, there are a bunch of great outcomes for those who are in a situation to use this strategy. These include:

- Using investment income to make extra repayments on your non-deductible debt, and

- Replacing your debt with tax-deductible debt (the interest is what is deductible, not the entire amount).

Indirectly you are able to diversify your portfolio into things like shares or other properties, and potentially even achieve some passive income from any positively-geared investments. Having other assets that you need to look after, such as investment property, can also be used to reduce your taxable income. Not to mention the ongoing benefits of growing your family wealth. This truly is a long-term strategy.

Approach the strategy with care

What debt recycling is not. Debt recycling isn’t a magic bullet for your bank account. In order to be successful, it requires the same perseverance and good savings and money management skills as any other financial strategy. Not to mention, the ability to follow through on paying off your debts!

Experienced investors may feel confident of managing this kind of strategy on their own. Nevertheless, we recommend that most people seek the advice of a financial advisor, who is capable of evaluating their current financial situation.

Is Debt Recycling For You?

You can assess whether debt recycling is the right strategy for you by looking at a few areas of your financial life.

- Do you own your home (with a current loan), and have you built up equity?

- Do you have a stable income that allows you to pay off your loan, and still have some surplus cash flow?

Once those practical questions are answered, you need to consider what you want to get out of this strategy.

- Are you interested in having a long-term focus towards investment goals? Debt-recycling is not suitable for short-term results.

- Do you have an understanding of the risk involved and are you comfortable with your ability to weather some market fluctuations?

- Finally, do you have any level of protection for you and your family in case of an emergency? For instance, if you cannot work for a period of time due to injury. When faced with a situation like this, income protection insurance can be extremely valuable.

If you feel comfortable answering yes to these questions, then debt-recycling could be a good option for you. If you’d like to discuss your eligibility for this kind of strategy, you can call our office on 07 3852 4114 to talk with a financial advisor.

Thinking About Loans & Tax

These strategies are a completely legal way of using your debt to reduce your tax. Keep in mind that the Australian Tax Office is very clear about what you can claim in this regard. You can only claim interest on a debt that has been incurred for an income-producing purpose, according to the official statement.

Another thing to consider is how to approach your loans. There are a variety of methods and rules around loan splits, using your offset account effectively, and even ensuring that your home loan has the flexibility for this strategy. Some professionals will also recommend using different combinations of interest-only loans and principal-and-interest loans to achieve the most efficient financial result.

We won’t go into too much detail here, as these complicated decisions are so particular to each individual. We recommend getting financial advice, and also speaking with a mortgage broker if you are not sure what your current loan will enable you to do.

Still Unsure About Debt Recycling? We Can Help

In summary, debt recycling is a wealth creation strategy that can be beneficial if you are an investor who is comfortable with the risks, has access to good advice, and has the means to support your strategy.

If you think debt recycling sounds like something you’d like to consider to help you build wealth, you’re welcome to contact our team for a free consultation.

We provide professional advice to everyday families, and we’ve helped many of them grow their wealth using techniques such as debt-recycling. We get to know you and then we assess your situation and short, medium and long-term goals before guiding you in making the financial decisions that will really make a difference.