Receiving an inheritance can be an emotional and confusing experience. It often comes after the loss of a loved one and can be difficult to decide what to do with the money, combined with many new and unfamiliar inheritance terms and concepts to navigate. It is important to take the time to grieve and process your emotions before making any significant financial decisions. Seek support from family, friends, or a counsellor if necessary.

Once the mourning period has passed, you should start thinking about how to use your inheritance in a way that enhances and helps your future financial security. Receiving an inheritance can provide an excellent opportunity to create lasting financial stability, but it also comes with its own set of challenges.

It is important to understand how inheritance money works and how to employ effective strategies to protect it.

This glossary provides definitions of common inheritance terms, to help you understand the different terms related to inheritance. It is not a comprehensive guide to inheritance law; you should speak to your solicitor if your have questions about your inheritance. If you are thinking about what to do with your inheritance money and how to manage your inheritance effectively, we recommend talking to a financial advisor.

Asset – An asset is any resource owned by an individual or business. These assets tend to hold monetary value such as fine jewellery, vehicle, apartment or house.

The two types of assets are tangible and intangible. Intangible assets can’t be touched or seen. Examples of intangible assets are copyrights, patents or trademarks. Tangible assets on the other hand are physical and are the common sources of assets passed on to inheritance.

Common sources of inheritance assets in Australia include the following:

💡 It is essential to understand the specific assets that make up your inheritance money and how they are distributed. For example, if you inherit a property, you will need to consider the costs of maintaining the property such as property taxes, insurance, and annual maintenance.

Beneficiary / Beneficiaries – A beneficiary can be a person, group of people, business or any charitable organisation. They are mentioned in the will and are usually said to receive the assets passed by the deceased.

Bequest – It is the process of gifting or giving something in a will to another person, to charity or to organisations upon that person’s death. This can be in any form of assets.

Capital Gains Tax – Capital Gains Tax (CGT) may apply to individuals and businesses when events such as the selling of property or assets received from the deceased. CGT terms may come up and apply to you if you dispose of an asset you inherited from a deceased estate. The details of CGT will depend on your relationship with the deceased. The ATO has provided more information on CGT that can answer many of your questions.

Deed – Deeds are most commonly used to transfer ownership of property or vehicles between two parties. The purpose of a deed is to transfer a title, the legal ownership of a property or asset, from one person or company to another. There may also be tax implications involved in the transfer of assets.

Estate – An estate or a deceased estate refers to all of the property, assets, liabilities and debts that belong to the person who just passed away.

Estate Planning – Estate planning is the process of arranging and managing the deceased assets, properties, and affairs to ensure their proper distribution and fulfilment of wishes upon incapacitation or death. Estate planning is important for everyone and could be as simple as making sure your superannuation beneficiaries are up to date. However, there are many steps in the process of estate planning. Consider consulting professionals and experts such as lawyers and financial planners to ensure your wishes are properly documented and implemented.

💡A financial planner can work with lawyers and accountants to develop a comprehensive estate plan tailored to your specific needs, looking into tax planning to plan and minimise potential disputes among beneficiaries, and protecting your assets from potential creditors or legal claims.

Executor – This person (or people – there may be more than one) generally manages the deceased’s financial affairs and will carry out the deceased wishes in accordance with the will.

Family trust – In Australia, a family trust is a type of trust that holds the family’s assets. They are usually created to protect assets or for tax reasons.

💡 If you have recently received an inheritance, setting up a trust fund is a wise way to protect your wealth and provide for your family and future generations. A family trust is separate from business assets and can safeguard your wealth from creditors and lawsuits in worst-case scenarios.

Grant of probate – A grant of probate is a Supreme Court document that recognises someone’s authority to deal with the estate of a person who has passed away. Probate is often needed before the executor of a deceased estate can take control of the estate’s assets (administer the estate).

Gift – A gift is a transfer of money or property that is made voluntarily by the giver to the receiver. The giver does not expect anything in return and does not receive any benefits from giving the gift.

💡Gift recipients are mostly people under the age of 25 who tends to receive smaller gifts, whereas inheritance is usually people over the age of 50. The total value of gifts was approximately $14 billion and the average value of give giving was $8000 from 2018-2019.

Guardian – A guardian is someone assigned by the law to take care of and make decisions for someone who cannot do it themselves, usually because they are too young or unable to handle their own affairs.

Heir – The term ‘heir’ is not a legal term in Australia, but it is sometimes used informally to refer to the person or people who inherit the property or assets of the deceased.

In Australia, if someone passes away without a will, their property is distributed according to the laws of intestacy, which vary from state to state. Their property goes to their successor, either their kids, grandkids, close relatives or whoever is the person legally entitled to a person’s property upon their death. That person or people who inherit under these laws are called the ‘next of kin’ or the ‘beneficiaries’.

Inheritance – Inheritance refers to money or assets that are passed down to the beneficiary. This can come from various sources of assets. See our FAQ to find out the difference between a gift and an inheritance.

💡It’s important to understand these differences when deciding how to pass on wealth to your loved ones. A financial planner or estate planning solicitor can help you make informed decisions about the best way to transfer your wealth.

Inheritance tax – It is when a tax is paid on the value of the property, money, and other assets of someone who has died. You might be asking do you need to pay tax on inheritance money in Australia. The answer is No.

While many countries have an inheritance tax, Australian law is unique in that there is no tax law on inheritance. Any assets that are passed down to family members, will not be taxed – whether the assets are financial, property or otherwise.

However, you may have tax obligations for the assets you inherit such as capital gains tax, and income tax. As a financial advisor, we are not able to advise you on this topic but we do have a highly regarded tax professional we can refer you to – just contact our team.

💡In terms of superannuation, the super balance of the deceased will usually be organised by the superannuation fund. Super paid after the death of a person is called a ‘super death benefit’ which will be paid out as either a lump sum or an income stream. In some cases, super will be liable to tax, but this will be assessed on a case-by-case basis.

Legal Personal Representative (LPR) – The authorised LPR has full authority to manage the deceased’s tax affairs with unrestricted access to ATO-held information and assets of the estate. An LPR is a person who is legally authorised to represent the deceased individual or deceased estate (if required).

💡The word ‘legal’ does not mean the person must be a legal practitioner. The LPR is usually the executor named in the will, or an administrator appointed by the court (which can be the next of kin). There can be more than one LPR for an estate.

Next of kin – A person’s next of kin is typically their spouse or closest living relative. The following hierarchy determines who is the most senior next of kin (in order): spouse or domestic partner; adult son or daughter (eldest surviving takes seniority).

This applies to inheritance situations when the deceased does not have a will or executor. However in Australian law, the word ‘next of kin’ does not exist but it is usually the same as inherited.

Probate – This is the process of proving that the will is correct. Probate necessarily happens to ensure that the assets left behind are distributed in accordance with the deceased wishes and that any debts and taxes are paid. In Australia, the executor will need to apply for Probate and until a Grant of Probate is received, the funds and assets are released or cancelled.

Probate is not a compulsory legal process in Australia but when it is needed, it can be a lengthy and expensive process. Probate can be avoided in some cases when:

As a financial advisor, we are unable to assist you with probate however we can work with your lawyers to plan your estate post inheritance.

Power of Attorney – It is the process of giving someone you trust the power to make decisions about your financial affairs and act on your behalf.

Superannuation death benefits – This is the amount of super that is paid after the death of a person. It is usually paid either a lump sum or an income stream and in some cases, the super will be liable to tax, but this will be assessed on a case-to-case basis.

Tangible property – Tangible property refers to physical assets that can be touched, seen, or felt. It includes objects such as buildings, land, vehicles, machinery, furniture, and personal belongings. Unlike intangible assets like stocks or intellectual property, tangible property has a physical presence and can be physically owned, transferred, and used by individuals or organisations.

Trustee – A trustee is someone chosen to handle and oversee assets or property for others. They are responsible for making decisions and following the instructions in a trust document to benefit the beneficiaries. The trustee must act in the best interests of the beneficiaries and manage the assets carefully and responsibly.

Will – A will is a legal document that outlines a person’s wishes for the distribution of their property and assets after their death. It specifies who will inherit their possessions and who will be responsible for carrying out their wishes. A will can also appoint guardians for minor children and establish trusts for beneficiaries.

Yes, superannuation can be passed on to beneficiaries. When someone passes away and does not have any dependents or legal representative, their superannuation savings may go to the government. No nomination can also mean that their super death benefit either goes to an estate or the trustee of the super fund will determine who the beneficiaries are.

This is why nominating beneficiaries is important and can be as easy as filling out a form on your super fund website. There are 4 different ways you can nominate a beneficiary:

You cannot nominate your parents and siblings as beneficiaries; only dependents are valid nominations. However, you can pass your super onto your parents or siblings if you elect to pass through your ‘legal personal representative’, your will. Your super is paid to your estate and then distributed to beneficiaries per the terms of your will.

The key difference between a gift and an inheritance is the timing of the transfer. Gifts are given during the lifetime of the giver while inheritance is given after the giver has passed away. Gifts are often given or transferred in small amounts whereas inheritance is much larger.

Another difference is the legal implications where gifts are typically given without any strings attached while inheritance is usually distributed according to a will or trust. This means that the beneficiary of inheritance may have to meet certain conditions or requirements in order to receive their share of the inheritance.

Under Australian laws, the beneficiary can refuse their inheritance. If you are considering this option, you can disclaim interest in the deceased estate. To do so you must sign a disclaimer document within a certain period of time. Once the disclaimer is filed, the executor will distribute the inheritance to the next eligible beneficiary. If you are considering disclaiming an inheritance, you should consult with a solicitor for more tailored advice depending on your state and situation and to discuss your specific circumstances.

John reached out to us after receiving a lump sum of $120,000 after his mother passed away. He was still in his early 20s, working part-time, and had no knowledge or investing experience. He wanted to use the money wisely and recognised the need for professional help. He was particularly concerned about not wasting the money because he had inherited it from selling his mother’s house.

I dove deep into John’s current financial situation and evaluated the best strategies to invest his inheritance money in a way that would help him set up his future. We assessed what his risk profile would be taking into account his attitude towards risk and his timeframe for investment. We then created a comprehensive Statement of Advice (SOA) that factored in his future goals, his risk tolerance, and a plan to create wealth over time…

Our financial forecasting showed that, if John followed his Financial Plan, in 5 years, he would be able to purchase his first house. This plan also shows that John only needs 50% of his inheritance money and a $400 monthly contribution to reach his financial goals. In 10 years he would be on a good pathway for retirement.

John was grateful for the advice and felt confident that he was making the right decisions with his inheritance money. He was also relieved to know that he was on track to achieve his financial goals.

Dealing with a significant inheritance can be a challenging experience. It’s completely understandable to feel uncertain about the next steps. Yet, it’s important to remember that the person who left you this asset wanted you to have it. If it’s appropriate, it might be helpful to take some time to reflect on their wishes and priorities and consider how they would have wanted it to be used.

❌ Be careful not to rush into anything. Think about what your financial goals are. Then take your time and do your research before you start spending the money or making any investment decisions. This is a good time to speak to a professional financial planner who can help you project how your inheritance can be used to make the biggest difference in your financial future.

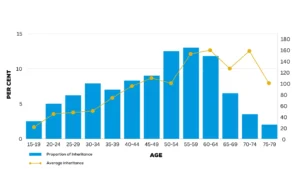

Researchers have found that 70% of money passed down by parents goes to people older than 50 who inherit 170,000 Australian dollars on average. This would mean that the receiver is likely in the state of nearing retirement. If you are one of these people, it is important to start thinking about how you will use this money to fund your retirement.

A financial advisor can be incredibly useful in assessing your situation whether you are under 50 like John in our case study, or over 50. They can offer advice on how to best manage your money apart from retirement such as setting up an emergency fund or paying off any outstanding debts. They might also consider investing in property or shares depending on your financial situation.

A word of caution, the included material in this blog has been provided as General Advice only. We have not considered your financial circumstances, needs or objectives and you should seek the assistance of your Adviser before you make any decision regarding this communication. We have taken care to prepare this material, but any decisions or actions you take as a result of you reading this communication are entirely your own. For more clarity on how advice could help you, please get in touch with us here.