Self-managed Superannuation Funds (SMSFs) are a type of superannuation fund that allows individuals to take control of their retirement savings.

Rather than holding your superannuation with Sunsuper, Australian Retirement Fund, or an industry fund such as Rest, SMSFs allow you to control your own investments and even incorporate property or other assets.

An SMSF is a compelling tool to save and control your retirement savings. However, there is a lot of misinformation and questions surrounding SMSFs and their proper use, partly due to differing advice from finance professionals over the years, and also due to the individual nature of each SMSF.

Setting up a Self-Managed Super Fund (SMSF) can be a complex and time-consuming process, with quite a few regulations and rules to understand. They should not be taken on lightly and require careful consideration before proceeding.

In this article, I’ll break down each element of SMSFs, from my 15 years of working with them. You’ll get a clear understanding of how SMSFs work, and who can benefit from them (because they are not for everyone!). So let’s get started.

Self-managed superannuation funds are a way of privately managing your retirement money yourself, including how and where it is invested. As it is compulsory to have a Superannuation retirement fund in Australia, SMSFs are a way of meeting that requirement on your own terms. They are a private superannuation fund, and are subject to a range of laws and regulations that anyone who is the trustee of the fund should be familiar with.

The difference between an SMSF and other superannuation funds is that the members of an SMSF are usually also the trustees. This means members of the SMSF run it for their own benefit and are responsible for complying with the super and tax laws. Instead of getting your employer super contributions into an industry superfund, your superannuation gets paid into the SMSF you manage personally.

SMSFs have become increasingly popular in Australia in recent years. In June 2020, the Australian Taxation Office (ATO) found that there were more than 596,000 SMSFs, with a total of over 1.1 million members and owned assets valued at over $747 billion. However, contributions to SMSFs have declined significantly in recent years, dropping by $24 billion or 60% since 2017.

The question of whether it is worth having a SMSF depends on your financial situation, what returns your SMSF can provide, what assets you invest in, how capable you are as a trustee, and how effective the advice you receive is.

Along with the responsibility to abide by the laws and regulations for SMSFs, you are also obligated to work with an accountant, have audits and supervision, and pay ongoing expenses. Setting up an SMSF can be costly depending on the fund size.

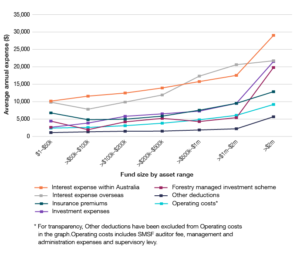

In the 2018-19 SMSF Investment performance report, the annual average total ongoing expenses were $15,300, with operating expenses averaging $4,000 (this is across funds with a range of asset values). Immediately, you can see that the expense ratio is a lot higher for smaller SMSFs. For assets in the $1 to $50,000 range, the average total expense ratio was 17.6%, with average expenses at $4,400, and median expenses at $2,000.

Image from the Australian Taxation Office

For funds with a value exceeding $2 million, the average total expense ratio was much lower at 0.7%. Average expenses for this range were $28,600, and median expenses were $15,900 (a higher expense, but a much lower percentage of the total).

These are not fees to financial advisors but are the cost of SMSF auditor fees, management and administration expenses, and supervisory levy to maintain your superannuation fund.

There are some amazing benefits in having a SMSF but the big question is why do you want one? They are extra work and sometimes an extra headache. I believe that you need to have a good reason to get one and it is on a case-by-case basis.

Some strategies which illustrate the financially complex uses of an SMSF include:

From this, you can see that an SMSF is not for everyone. If you are deciding whether you should set up your own superfund, take some time to ask yourself the following questions.

Many individuals find themselves contemplating whether to set up SMSF when they have accumulated a large sum in their superannuation accounts and want to do something more with it. Many others come to the idea of setting up an SMSF because they have specific investments they want to make, such as using their retirement fund to invest in property.

Setting up an SMSF simply to buy property can be a decision that misses much of the nuance and forward planning required for an SMSF to perform well. However, there are situations where it can perform well. For instance, if you are a small business owner and want to buy a commercial property for the company, or if you have a diversified portfolio that includes investment property.

If an SMSF gives you so much flexibility in your investments, why doesn’t everyone have one? This is because, despite the advantages there are also many drawbacks, including increased risk, greater administration costs and fees, and a lot more work. However, if you have the financial foundation, the understanding of investments and assets, and the time to commit to being a trustee, it can be worthwhile.

Josh and Anna are a couple in their late 30s who are interested in building their wealth. They are both full-time employees with a combined annual income of $250,000 and a combined superannuation balance of $172,000. They have decided not to have children and they live in their own home.

Josh and Anna have $70,000 remaining on their mortgage and a surplus cash flow of $45,000 per year. They have been using this surplus to pay down their mortgage, but they are now planning to redirect it to increase their superannuation contributions.

Josh and Anna have gained investment experience through a share portfolio that they have been investing into regularly for the last 10 years. They have sought advice from our financial advisors about their investments and superannuation fund, so they are comfortable with how the market works and have experienced how investment strategies can be used.

Josh and Anna are interested in switching to a self-managed superannuation fund. We have evaluated their situation, and there are indicators that an SMSF would suit them.

Our financial advisor thinks that the couple may benefit from setting up an SMSF and will continue to work with them to ensure that their SMSF is managed in a tax-effective and responsible manner.

Most people don’t need to set up an SMSF. Just switching to the right super fund with lower fees and the right investment strategy will often be enough for you to optimise your retirement fund. We don’t recommend our clients create their own SMSF if:

Considering your feelings about these ‘prerequisites’ – and getting good advice – will help you make an informed decision about whether setting up an SMSF is the right choice for you. Setting up an SMSF entails adding significant responsibilities to your life. It also puts the performance of your retirement fund, and ultimately its final balance, in your hands.

Kayla and Tod are a couple in their early 40s with two young children. They work in the healthcare industry and have a combined annual income of $250,000. They have saved up $100,000 to buy their family home and a surplus cash flow of $30,000 per year.

They have no investment experience and struggle to stay on top of managing their own financial affairs. Kayla has recently had some health concerns that are being investigated. They have $172,000 superannuation combined.

Kayla and Todd were interested in getting an SMSF as a way to invest in property to try and build their wealth more quickly, given their late start into the property market. We evaluated their situation and decided to recommend against them getting an SMSF.

Our financial adviser recommended that they continue with their current superannuation and insurance arrangements and focus on buying their family home.

They can revisit the idea of an SMSF in the future if their circumstances change.

It’s now become possible for younger investors or those with smaller balances to enter the world of SMSFs. Previously, it was not recommended that clients with $200,000 or less in super should not set up an SMSF as their returns would not balance out the admin costs. However, the University of Adelaide published research that found there was no real difference in performance between having $200,000 or $500,000 in your SMSF. ASIC removed their benchmarking restrictions in December 2022.

Now there is no minimum starting balance to set up an SMSF, this kind of superfund is accessible to more Australians. However, though it would be possible to set up an SMSF with a lower balance such as $100,000 – $200,000, your SMSF becomes much more profitable once your balance is over $200,000.

This is because of the expense ratio and the fees that we discussed earlier. However, new finance tools are becoming available to support smaller SMSFs with administration and reducing the overhead costs. If you’re interested in starting an SMSF with a lower balance, our financial advisors can help you find out if you are eligible.

When you’re thinking about whether an SMSF is the right choice for you, you should spend some time considering if you understand the principles of investing and if you are comfortable taking on these responsibilities as the trustee of your own superfund.

Of course, many of the basic investing guidelines can apply to investing within your SMSF, but if you have multiple members, you also have to consider that the strategies you adopt work for them as well.

Some of the main things to consider include 1) diversification, and making sure all your eggs aren’t in one basket, 2) your timeline to retirement, 3) whether you want to sell appreciated assets to fund retirement or whether you will live from dividends or investment income. These factors can often form a foundation for many other decisions that you will need to make.

FAQ: In my SMSF, do I control where my assets are allocated?

Yes, the trustee and members have control over which assets and investments are selected. I recommend that you ensure you have clarity on your personal investment goals and how your investments will create the returns needed, before you set up your SMSF. Your investment strategy needs to comply with SMSF regulations, so it should be reviewed by both an accountant and an auditor to ensure it continues to meet the retirement goals of each member, it takes into account their age, employment status, retirement needs, and risk tolerance, and any assets are legally held by the SMSF, not by an individual.

FAQ: How do segregated assets work in an SMSF?

In an SMSF, you can ‘segregate’ assets into different groups that are owned by different members (or partly-owned in different percentages). This is useful when the fund has multiple members with different investment goals or retirement timelines, or if multiple properties are owned for different purposes. Using this structure can be very helpful to ensure that the SMSF investments are managed to meet each individual member’s needs.

FAQ: What investments are recommended in an SMSF?

The investments that are best for your SMSF will depend entirely on your individual goals, age & time to retirement, and SMSF balance. However, one important tip is to create a diversified portfolio from a mix of asset types (such as shares, commercial and residential property, and cash). This creates a much more resilient portfolio in case of market downturns.

As many people initially want to set up an SMSF in order to purchase property, I’ll review this strategy so you can see if your situation fits with the requirements. Moneysmart also provides some details on property rules.

If you’re looking to buy a property through your SMSF, it must be solely to provide retirement funds to the members of your SMSF. Trustees and members of the fund cannot live in or rent the property, and neither can any relations of the fund members. Additionally, this strategy cannot be used as a way of passing assets, so you cannot purchase your SMSF property from any relations of fund members.

There are quite a few risks associated with SMSF property that are not associated with regular investment properties. This is because of the extra restrictions and administration costs associated with property within an SMSF.

FAQ: Can I live in a property owned by my SMSF?

SMSF members are not allowed to live in a property owned by their fund until they retire. Once they retire, they can transfer the property to themselves, but only if they have reached the age when super rules allow this to happen.

FAQ: Can I rent my investment property out to my family members?

No. Properties owned by your SMSF can only be rented to individuals who are not members of the fund, and have no relation to the members of the fund.

FAQ: Can I run a business from a property owned by my SMSF?

If the SMSF was used to buy a commercial property then that commercial property can be leased to a fund member of the SMSF for their business. However, you must follow market rates and specific rules.

If you are considering establishing an SMSF, you should be aware of your legal obligations, as well as the costs and time associated with ongoing management. According to ASIC, on average, SMSF trustees dedicate over eight hours per month to managing an SMSF.

The initial setup of an SMSF involves a number of steps, including registering the fund with the ATO, obtaining a trust deed, planning your SMSF investment strategy, setting up an SMSF bank account and completing various compliance and reporting obligations.

It is a big responsibility to manage your own SMSF, and if you get it wrong, there are potentially catastrophic impacts to your retirement fund. Therefore you should always consult with a financial advisor or SMSF specialist, and read the guidelines provided by the ATO.

In conclusion, setting up an SMSF is worth the time for those who want greater control over their retirement savings, who have a super balance large enough to achieve good results, and who have a good understanding of investments. However, we can’t stress enough how important it is to seek professional input before taking the leap.

It’s important to note that there are strict rules around what you can & can’t do within the Superannuation environment and it’s always important to seek advice from your licensed Financial Advisor or Accountant.

If you’d like to speak to our team and My Wealth Solutions, we have SMSF specialists like myself who can quickly evaluate your financial situation and give you genuine feedback on whether you will gain or lose from setting up a self-managed super fund.