Stop for a moment and imagine your ideal retirement…

Are you travelling to foreign countries? Enjoying time cruising, or taking your grandchildren to the beach? Spending the day on the golf course or entertaining your friends on your back deck?

The perfect retirement looks different for everyone. But what you’ll need to really enjoy it is confidence. Confidence that when you say goodbye to earning a paycheck, you won’t one day run out of money.

As the life-expectancy of Australians continues to trend upwards, 66% of people, particularly those closer to retirement, report being worried that their retirement fund won’t last. Knowing how much money you’ll spend over the next 35 years isn’t easy! The only way to get confidence in your retirement is through proper planning and knowing your options.

More confidence in the financial side of retirement means you have time and energy to spare on creating a post-retirement life filled with meaning and purpose (which is really what this is all about!).

With lots of different numbers going around about ‘how much you need to retire’, many clients come to us feeling anxious about their retirement. We’ve created this retirement planning checklist to take you step by step through how to plan the right way for your unique retirement.

Key Takeaways

- How to look at the big picture of your retirement, as well as the detail

- How to build in flexibility for unforeseen expenses

- How to set up your income streams for retirement based on your timeline

- How debt impacts your retirement and what to do about it.

First, Understand Your Retirement Needs

Planning for your retirement is not just about the money. Everyone retires with different hopes for their retirement, as well as a different amount of money saved. It’s more about how you use your resources most effectively to really enjoy your golden years with confidence.

What Kind of Retirement Lifestyle Do You Want?

Thinking about your retirement goals can also help you emotionally prepare. It can help you ensure you have meaningful activities to spend your time on, rather than struggling with boredom or a lack of purpose. Looking at what you want to do with your time and energy once you are no longer working is an important step in financial preparation too.

- List the kind of activities or lifestyle that is important to you in retirement.

- Think about your housing situation and what you’d like to do for your retirement years.

Your lifestyle now vs your retirement lifestyle

You can use your current lifestyle to craft both an expectation for your retirement standard of living and a budget (how much do you currently spend, and will you want to continue doing so).

- Review your current foundational expenses such as housing, groceries, and bills

- Add on discretionary spending that you’d like to include, such as travel or dining out.

Calculating your retirement gaps

Now that you have a good understanding of the kind of activities you’d like to do in retirement, as well as your living costs and discretionary expenses, it’s time to check your retirement fund. When calculating your retirement target, factor in the impact of future inflation, as $50,000 today will not be worth $50,000 in 10-20 years. If you have a gap, start planning how you might reach your retirement income target.

Budgets for various households and living standards for those aged 65-84 (December quarter 2023)

| Comfortable lifestyle (p. a.) | Modest lifestyle (p. a.) | ||

| Couple | Single | Couple | Single |

| $72,148.19 | $51,278.30 | $46,994.28 | $32,665.66 |

- Review the ASFA Retirement Standard to get an idea of where your desired lifestyle sits on the Modest to Comfortable Retirement spectrum. Note that this presupposes that your mortgage is paid off.

- Think about your ‘time in retirement’; how long you anticipate to support yourself from your retirement savings.

- Use an online calculator to estimate the value of your retirement fund at the age you’d like to retire.

- Note down your housing situation and if you’ll be free of debt at the time of retirement

Planning Your Timeline to Retirement

One of the most important elements of retirement planning is how long you have until you are able to retire. Hopefully, you’ll be able to retire exactly when you want to, but sometimes you might need to build in flexibility to increase your fund balance (and therefore your financial security) at retirement.

Preservation Age & Qualifying Age

First, the age that you’ll be able to access your superannuation is known as your ‘preservation age’. You’ll be able to access your super at this age if you have retired or stopped working, however if you’re still working you’ll have to wait until 65 to access super.

| Date of birth | Preservation age |

| Before 1 July 1960 | 55 |

| 1 July 1960 – 30 June 1961 | 56 |

| 1 July 1961 – 30 June 1962 | 57 |

| 1 July 1962 – 30 June 1963 | 58 |

| 1 July 1963 – 30 June 1964 | 59 |

| From 1 July 1964 | 60 |

Your Qualifying Age, on the other hand, is when you are able to access the age pension. This is usually around 7-10 years later than preservation age, with limitations and requirements on who is able to access the government pension.

Transition to Retirement

The transition to retirement strategy is a good option for those who may not want to draw down their superannuation in full from preservation age. Some will use it to work part time while supplementing your income, while others use it to boost super and save on tax while continuing to work full time. Transition to Retirement enables you to use less superannuation in the early years of your retirement, but it can be complicated so we recommend you see a financial advisor about this one!

- Consider how long you plan to continue working and what age you’ll retire

- If you’d like to keep working longer, consider if the Transition to Retirement strategy would be appropriate for you

- Find out if you qualify for the age pension & decide if and when you’d access support

Using Your Timeline Effectively

How much time you have until you retire can really change how you choose to plan. If you are in your 20s, you have around 40 years to create financial strategies and set ambitious savings targets. With a longer timeline, you can weather the risks of high-growth strategies.

However, if you are in your 50s, you might need to take a conservative approach with lower-risk investments and focus more on property and super. If you find that you are not where you want to be, you may have to plan for a more modest retirement lifestyle.

Case Study: James & Michelle

James and Michelle, ages 59 and 62, own their home and have $335k in cash savings. James has $373k in super and Michelle has $86k. Both were still working but James decided he would like to retire immediately as he has had a family member pass away recently which was a bit of a shock. Michelle is working part time and keep working for now. They have a caravan and like to do regular trips around Australia.

James and Michelle were mainly concerned about super, and how to use it to generate retirement income. We worked through their living expenses and set up a retirement budget that gave them a clear weekly amount to cover expenses in addition to having funds to enjoy themselves.

As James had not yet reached his preservation age, retirement for him was a little more complex. We used his long-service leave and annual leave to fund 3 months of living expenses, then calculated and put aside the savings he would need until he could access his super in just over a year.

The main part of the plan was a contribution strategy for both James and Michelle. We maxed out their caps over the last five years (resulting in savings of over $11,000). Some of their savings were put aside in an emergency fund. We then contributed the bulk of their cash savings to Michelle’s super fund for two reasons: she had a significantly lower balance and she was able to access them as she had reached her preservation age. Invested through super, these savings were then able to generate ongoing income.

Most importantly, we wanted to ensure that their retirement fund would last throughout their retirement years. We created an investment strategy to ensure that their superannuation would generate good returns while keeping funds available for ongoing retirement income through their account-based pension. This strategy worked as a buffer against market downturns (to avoid the need to sell assets to cover their income), and instead have time for the investments to recover any lost value, which prolonged the longevity of their investments.

These strategies ensured they were confident and comfortable with their retirement planning and budget, and that they would be able to draw their desired retirement income tax-free for 28 years. Upon reaching their 80’s, their superannuation income will reduce, and we supplemented the plan with age pension entitlements that will become relevant at that time.

Your Retirement Income: Superannuation & Other Income Streams

How to Maximise Superannuation Now & Pre-Retirement

Super forms a critical part of a successful retirement plan so it’s surprising how often it is treated as an afterthought.

The Power of Voluntary Contributions

Making extra contributions can vastly improve your super savings over time. You can do this before tax by increasing your employer contributions, as concessional contributions or salary sacrificing, up to $27,500 per year. After tax, known as non-concessional, you can contribute up to a maximum amount of $110,000.

We used a contributions calculator to get the following estimate: if you added an additional $5,000 annually to your super from the age of 35 to 67, you would increase your retirement fund balance by 48%, from $638,476 to $948,495. This includes additional compounded returns of $150,000.

Looking at your growth and investment profile

Do you know how your super is being invested or what kind of portfolio you’re invested in? The difference between growth and conservative can be very significant over 30 or 40 years. Your growth strategy should depend mainly on your timeline. A rule we follow is that the closer you get to retirement age, the more you should move your investments from growth to defensive.

Many superfunds will offer a range of investment products, for example, you might balance your retirement portfolio between ASX and international shares.

- Check your superfund on APRA’s performance data to see if your Superfund performs well

- If possible, ensure you have opted in for the appropriate growth portfolios based on your timeline.

- If you’re not sure, get advice on whether your superfund is performing well or whether you should change superfunds.

Staying on top of fees and charges

It’s important to be aware of how much your superfund is charging you in fees. Some products have high fees, but they may not offer the returns to make it worthwhile over time. You don’t want to be losing a significant percentage of your retirement fund to fees.

- Identify the fees your superfund is charging. You can compare to the returns you’re receiving and to what other superfunds are charging.

Drawing Down Super

When you reach preservation age, you can access your super. Generally, you can do this by drawing down a lump sum, or choosing how much you want to transfer to the pension phase and setting up an account-based pension.

Based on your retirement budget, you choose your pension payment amount and how often you receive it. Consider the minimum superannuation drawdown rates and if you’ll need more than this for your annual income. We recommend calculating how long your superannuation will last based on your super balance, your pension, your ongoing investment returns, and your fees.

FAQ: Isn’t my employer’s super contribution enough?

Yes and no. If you can’t contribute more to your super, that’s ok. You will end up with a smaller income in retirement, but if you are unable to fully self-fund your retirement, you can access the age pension to help fill the gaps.

Our goal is for our clients to have the ability to be self-funded and stress free, so we do recommend you boost your pre-tax superannuation contributions if you are able to (and it is very tax-efficient if you earn a high income).

Contributing to super also becomes more and more beneficial as you get older: If you’re over 50 years old, the superannuation contribution limit becomes $50,000, and once you’re over 60 your super withdrawals are tax-free.

Waiting until you’re older to contribute to super would be a huge waste of an opportunity to reap the benefits of compounded interest.

Qualifying for the Age Pension

The age pension is a wonderful assistance to many retirees. However, living on just the age pension can be stressful and even lead to financial hardship, as it’s a very modest income. For example, a couple would receive $1,682.80 per fortnight, and that amount could reduce if you had regular income from investments or work.

It’s helpful to recognise if you’ll qualify for the age pension or not. Some people fall close to the edge – they don’t qualify but they also feel like their self-funded retirement isn’t quite enough. We want to help you avoid that outcome!

- Check your pension eligibility, and decide if it is going to form part of your retirement income.

- If you’re concerned about depending on a modest pension for your retirement living, speak to an advisor about how you could boost your retirement fund now.

Building an Investment Portfolio

Another valuable thing to consider is building an investment portfolio outside of superannuation. There are several benefits: 1) you have more control over your investments, 2) you can draw money out prior to preservation age, and 3) it can help create a legacy or inheritance for your children or grandchildren.

An investment portfolio isn’t required to retire well. However, it’s extremely valuable to create wealth and diversify your assets, so we would recommend investing from long-term returns if you are able to.

Understanding your risk tolerance

Lower-return investments are more secure, while high-yield investments will usually have a higher amount of market volatility. Our strategies will always consider your cash-flow, your timeline, and your risk profile.

- If you currently invest, are you happy with your portfolio diversification and asset allocation for retirement? If not, spend some time thinking about the role your portfolio will play.

- If you’re not currently investing, consider if this is something you’d like to start doing. It’s particularly valuable if you have additional cash that you are currently not using.

Property Planning for Retirement

Property is very important to consider, in regards to reducing retirement expenses and thinking about care as you age. Each person’s situation is different.

- If you’ll be paying for housing after you retire, whether mortgage payments or renting, start to budget accordingly. This can be a drain on your retirement fund.

- If you’re currently paying a mortgage and want to pay it off by retirement, there are techniques that can help you pay your mortgage faster – ask us for more details!

- If you own your home or investment property, think about what happens to it as you age. You could use property to partially fund your retirement, or pass it on as an inheritance.

Downsizer Contributions

The Downsizer scheme allows people over the age of 55 to contribute up to $300,000 from the sale of their home as a non-concessional super contribution, outside of the contribution cap. This is a common way that retirees can move into a smaller home or a retirement village while boosting their retirement fund.

- Consider if you’d like to stay in your house, or if you’d like to sell and move somewhere smaller in retirement.

Budgeting Today for Your Future

Building a great budget now will set you up well. In particular, consider the areas that we’ve covered that need more support, based on your timeline to retirement. For example, if your current situation allows you to pay off more debt now, or contribute more to super, build that into your budget. Use today’s money for tomorrow!

Remember, if you are retired for up to a quarter of your life, a good portion of your lifetime earnings will need to go towards supporting you in those lovely retirement years.

Protecting Your Retirement Funds with Insurance

Many people suffer from serious injuries or sickness, both temporary and permanent, and need to draw on their superannuation well before retirement. Rather than putting your future comfort in jeopardy, we recommend having a financial safety net with insurance cover.

Income protection, TPD insurance, or trauma insurance can all provide some form of temporary or ongoing support, which can also protect your retirement savings. This is particularly valuable if you have financial responsibilities such as family or a mortgage. Additionally, it’s valuable to consider the role that life insurance and health insurance play in your overall financial strategy.

- Consider if you are protected if something were to happen, and what kind of insurances are a good option for you.

Dealing with Debt & Tax

Bad Debt vs Good Debt in Retirement

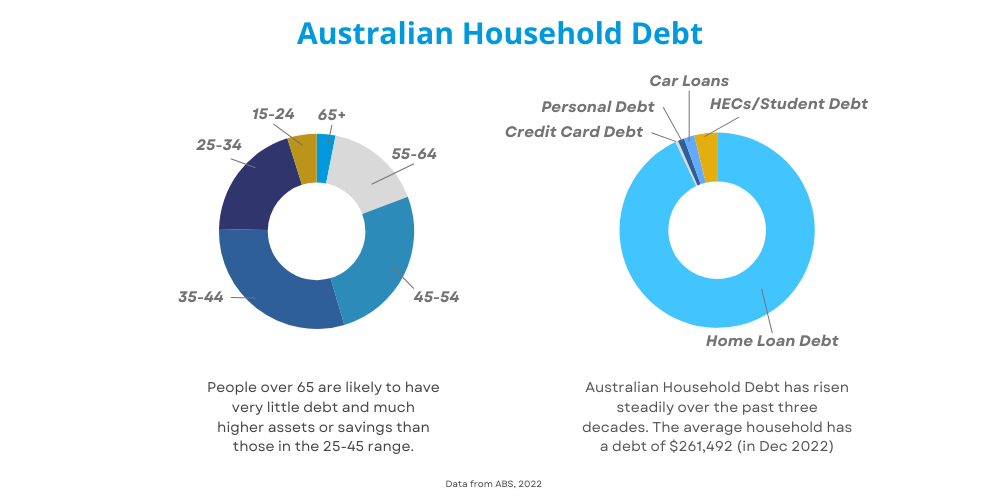

The average Australian household owes roughly $250,000 in debt.

This can also have a knock-on effect on the retirement prospects of many older people. According to the Australian Bureau of Statistics, a 65-year-old woman is now three times more likely to be still working than in 2020.

Not all debt is created equal. Bad debt diminishes your wealth in the long-term, as it is not attached to a revenue-generating asset. Good debt is attached to a revenue-generating or equity-building asset that ultimately makes your money back.

Outstanding debt can become a real drain on your retirement wealth. One of the ways we deal with bad debt is turning it into good debt through debt recycling. In general, this may not be an appropriate strategy if you’re close to retirement, but it can certainly help create more wealth in your life if you plan to retire in 10 or 15 years.

Taxation in Retirement

Taxation in retirement can be complex, however if you have a simple financial situation, you’ll be able to navigate it easily. However, if your finances are a bit more complex, it’s wise to talk to an accountant or financial planner.

How you drawdown your super and what you do with it can have tax implications. Concessional contributions that were deposited before tax are taxable at 15%, as well as superfund returns and earnings, but most superfunds will take care of this. Tax free components include after-tax contributions, government co-contributions, or downsizer deposits.

After the age of 60, you won’t need to lodge a tax return if your income is from a pension or a taxed income stream. However, if you have other investments or are still working, you’ll have to lodge a return for that income.

Completing the Picture of Your Retirement Years

We’ve covered so much already, but it’s important to now step back to get a view of your later retirement years. This can include philanthropic donations, legacy or estate planning, and what you’ll do when you can no longer completely care for yourself or your partner.

I understand the challenge of discussing these topics well before you’ll encounter them. The value of talking about this now is that you get the chance to clearly think through your decisions, and you’ll feel more peace because you’ve had a chance to decide what you want.

Thinking about Aged Care

Aged care can be one of the most costly expenses in retirement, and something that can be planned together with family or other supportive people in your life, particularly if your estate will support you.

Things you may need to consider include:

- Will you use at-home care, or residential aged care?

- Will you keep or sell your home? (this can also have estate planning implications)

- Where will aged care fees be paid from?

- Will you have the cashflow or other financial means to meet all your needs?

- How do you maximise your age pension or other social benefits?

- How do you protect your estate from being overcharged?

- How do you avoid costly planning mistakes?

- If you have ongoing investments, how will they be managed?

- Who will you have as your enduring power of attorney?

These are some of the main questions that can be covered in an aged care plan. While My Wealth Solutions doesn’t provide age care advice, there are many excellent aged care advisors who can provide advice on this once you retire.

Legacy and Estate Planning

Ultimately, many retirees have an idea of what they want to happen to their estate once they are no longer around. Some prefer to structure their money to retire early and spend all of their retirement funds. Others prefer to plan to leave assets or an inheritance to their children, grandchildren or a charity.

If you are planning to leave an inheritance or a legacy, it’s valuable to get advice on this even pre-retirement. If you have plans for philanthropy or bequests, include those in your initial planning. This is in order to structure your retirement assets in a way that optimises how you can manage your estate.

The primary things to consider in an estate plan are:

- Who will manage your affairs? It’s important to nominate a legal personal representative to be your trustee or estate executor. It can also be helpful to have an attorney who is across your estate plan and will.

- Who are your beneficiaries? Keep an up-to-date will so that there is certainty about your beneficiaries and your wishes for your estate.

- Work with an accountant or financial advisor to ensure your assets and their distribution are protected with effective tax planning to minimise undue tax liability.

- If you have a business, plan for the winding up of your business or create a succession plan.

Avoiding Retirement Mistakes

1. Not Planning Your Retirement Early

If you fail to plan for your retirement, it is almost inevitable that your retirement lifestyle will suffer. Ensuring that you have enough to live a comfortable life requires a structured approach and setting some financial goals for most people. Even if you are very wealthy, it’s important to ensure that you have a clear estate plan in place for your later years.

2. Not Reviewing Your Super

Your superannuation is not a set-and-forget retirement fund. Instead, it can be optimised and reviewed at the right times to provide additional growth and protection for your retirement fund.

If you’re approaching retirement, you should think about moving at least a good portion of your portfolio into more defensive assets. This is to avoid volatility, at the time of retirement, impacting how much you have to retire with. You can also think about switching your superannuation out of the accumulation phase when you are eligible, to avoid paying tax on super earnings.

3. Investing Incorrectly or Emotionally

Many Australians invest as a way to build additional wealth for retirement or a legacy. However, it’s possible to have a bad experience (and lose money) with investing if you make emotional decisions. This can look like pulling out when the market drops, and then reinvesting when the market is back up.

It’s important to ensure your investments are diversified and well-balanced, with consideration given towards growth in earlier years, and stability in later years. This reduces your financial risk while enhancing your potential returns.

4. Not Planning For Health Costs

It’s vital to have a plan for health care costs, from medication all the way to in-home care. The Association of Superannuation Funds Australia estimates that healthcare costs can be around 15% of weekly expenses at 65 years of age, increasing to around 20% by age 85.

If your current retirement budget doesn’t include healthcare, this might really impact how much money you actually have to spend on the fun parts of retirement. It’s also helpful to plan a buffer in case you have unexpected expenses in this area.

5. Not Paying Off Debt

Debt can really cripple your retirement lifestyle by sucking away a solid percentage of your weekly income. It’s really valuable to have a plan for paying off your debt as early as possible (while still putting money towards your retirement).

6. Not Planning for a Longer Life

It’s a strange position to be in – estimating how long you will live. However, it’s important when you will be financing up to 30 years of retirement living. We recommend getting some professional advice to structure your portfolio and withdrawals to last longer. You can also plan for how and when you will be eligible for the age pension.

Time to Action Your Plan (No Matter Your Age)

Putting the Plan into Action

While planning for retirement is an all-important first step, there’s only so far that planning can take you. You need to start evaluating your personal situation and activating the elements that are relevant to you.

You can use this guide to work through each step (and use the links to try out a retirement calculator or two), which will certainly get you a long way towards having your retirement sorted. I’ve included checklists throughout this guide, however you can also download it to work through with some additional resources.

If you run into any challenges or need help evaluating your options for superannuation and investments, setting up debt structures, or navigating the complexities of estate plans, we recommend that you see a financial adviser. It can make all the difference in your peace of mind and security in retirement.