You may already know a fair bit about your Superannuation. But with changes being introduced every few years, it’s wise to keep updated, as this can impact what you choose to do with your income or investments in the future.

Another round of superannuation changes was introduced to start on 1 July 2022. We’ve included all the details in this quick reference guide on 2022 superannuation changes.

Superannuation is the legislated program by which your employer pays a percentage of your earnings into an untouchable investment account for your retirement. It is at its most basic form of a forced savings plan for your retirement. Formally legislated in 1992 to provide security to an increasingly ageing population – and to relieve pressure on the age pension, superannuation has seen many changes and reforms in the decades since.

Superannuation has seen ongoing reforms over the last few years in particular. Many changes were introduced in the Superannuation (Objective) Bill 2016 and came into effect in 2017. The latest round of changes, effective 1 July 2022, aims to continue to reduce pressure on the age pension, as well as open the superannuation guarantee up to more workers earning less than the previous eligibility threshold.

Australia has one of the best-rated pension & superannuation systems in the world, according to the Mercer Global Pension Index – coming 5th after Iceland, Netherlands, Denmark and Finland. It’s your employer’s job to make super contributions on your behalf when you are employed. At the very least, they must add 10% (as of 1 July 2021) to your salary or wage and transfer that money directly to your chosen fund.

Superannuation is important to all Australians. As a nation, we are living longer and therefore need to ensure our retirement funds last longer because of this. By adding to your superfund well in advance of needing it, you can drastically alter the quality of life you will live in retirement.

Your super fund is designed to keep your money secure and growing through investments until you retire. Your Superfund will typically invest your money in various ways and are able to do this on a large scale when combined with other people’s funds. This gives you access to numerous investment opportunities, including currency, real estate, the Australian stock market, global markets, and other financial assets.

Superannuation is a valuable tool, no matter what your financial situation or net worth is. For some, a self-managed super fund is the right choice, providing more control over investments. For others, simply learning to make the most of what it offers towards your retirement can have enormous benefits. We recommend talking to a financial advisor to ensure your super is working for you.

Effective 1 July 2022, the amount of the superannuation contributions your employer must make has gone up. From 10%, it is now 10.5%. Moreover, the superannuation guarantee rate will continue to increase by 0.5% each year to 12% by 2025.

This change is intended to support our ageing population. Over the next decades, Australian families are having fewer children now, and the demographic balance will tip towards an older population, with fewer people paying taxes to support services such as the age pension. A small change to superannuation minimum contributions now will make a big difference in the future.

For employers: This means you will be required to pay the super guarantee at the increased percentage of 10.5% of the worker’s ordinary time earnings. This should be fairly straightforward, with the ATO working with payroll service providers to ensure that the software was updated in time for the change. This means you must allocate more funds towards employee superannuation but does not include overtime compensated overtime rates and GST.

For employees: For those who use salary sacrificing or make concessional contributions up to the cap of $27,500 per year, you may need to make adjustments or review your arrangements to ensure you don’t go over the concessional contribution cap.

Previously, only employees who earned more than $450 per month before tax were eligible for a superannuation guarantee. From 1 July 2022, employees will be eligible for a super guarantee regardless of how much they were paid during the month. Whether the employee earns $1 or is a high-income earner, super must be paid by their employer. Standard exceptions to this rule still apply, most notably that employees under 18 need to work 30 hours per week to qualify for a superannuation guarantee.

This change will positively impact over 300,000 low-income earners, the majority of which are young or female, giving them access to a benefit that higher-income earners have had for some time. It aims to enhance the equity in superannuation coverage.

For employers: Some of your employees who have not been eligible in the past may have become eligible from 1 July 2022. It is important to ensure that these employees have been fully informed of their eligibility and have nominated their chosen super fund. Particularly be aware of any changes in regards to contractors and sub-contractors, as they may now be considered employees in terms of superannuation. Even if someone is not technically employed by you, the arrangement may impose the same obligations as if they were. For example, the employer may be required by law to pay super to a subcontractor’s super fund.

For employees: If you fall into this category, welcome to the world of superannuation! Now is the time to check with your employer that all relevant paperwork has been completed and your superfund has been nominated, for your employer to start paying your superannuation guarantee.

For arts workers: Given there are some special rules for those working in the arts industry, it is worth finding out where you fit in regard to the changes. The removal of the $450 threshold opens up superannuation to many arts workers who were previously excluded. Arts workers are employees for the purpose of super if 1) they are paid for performance or presentation, 2) they provide services in connection with the above, and 3) they perform services in connection with making film or recording.

In Australia, age 67 marks your eligibility to receive the age pension. In the past, those who worked past this age would need to satisfy a work test in order to make or receive non-concessional contributions to super, as well as salary sacrifice contributions. The work test needed people to work at least 40 hours per week over a 30-day period during the fiscal year. The work test is still required for people in that age range who want to make personal deductible contributions.

Beginning 1 July 2022, people over the age of 67 will no longer be required to meet a ‘work test’ when making non-concessional contributions to super. This means that senior Australians, many of whom are still active or working part-time in some capacity, are able to continue contributing to their super as long as they are able to. This can even include additional savings or inheritances.

For retirees or pre-retirees: Ensure you make the most of this opportunity to add to your superannuation now. Keep in mind that there is a contribution cap and a limit on how much you can transfer into your pension fund. Your financial advisor may be able to help you use this to maximise your retirement funds and ensure you avoid paying unnecessary taxes.

If you do happen to go over your contributions cap or would like to make increased contributions now due to your situation changes over the next few years, there is good news. The bring-forward rule will now be extended to people up to 75 years old on 1 July 2022. This means that you may be able to access the next two future years’ caps on non-concessional contributions, increasing your contributions in the current year to potentially three times what they otherwise could have been. This is an excellent tool if you are soon to retire or change your source of income and have additional funds to put into super now while avoiding paying extra tax.

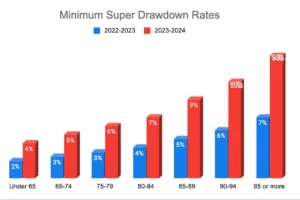

Introduced during COVID, the 50% reduction in the minimum drawdown rates from account-based pensions will be extended for another 12 months beginning 1 July 2022.

The minimum drawdown rate indicates the minimum amount a retiree must draw from their superannuation each year. This is good news for those who can incorporate more flexibility into their retirement income, as they won’t need to satisfy minimum drawdown requirements.

For retirees: This might be particularly useful to you if you have other means of income, such as investments or if you are living simply enough that you don’t use your full drawdown rate – take this as an opportunity for the next 12 months to reduce your drawdown and keep more money in your super or pension account for longer.

The Downsizer Contribution eligibility has been extended from 65 to 60, with legislation proposed to reduce it further to age 55. This is great news for those who are looking to sell their current home to move into a smaller place as they prepare for retirement.

For those who are pre-retirement age, the extension means they may be able to reach their retirement goals earlier. The Downsizer Contribution allows them to put the proceeds of the sale of a home straight into their super, up to a maximum contribution of $300,000 per individual or $600,000 for a couple. This Downsizer Contribution is not counted towards your non-concessional cap.

For retirees: Find out if this is right for you by checking if you meet the requirements (for instance, you need to have owned the home for at least 10 years), and talk to your financial advisor about if this fits into your retirement strategy.

The First Home Super Saver Scheme, which assists first-time home buyers in sourcing a deposit for their first home through their superfund, has been boosted from 1 July 2022.

Previously $30,000, qualified individuals can now draw down $50,000 from their super account to add to their house deposit funds. For instance, a couple looking to buy a home could draw down up to $100,000 in total to use as their down payment.

There are some rules around using the FHSSS, including a requirement to live in the purchased property for 6 months after purchase, and the requirement to sign your house contract within 12 months of accessing your FHSSS otherwise, you’ll be hit with a tax bill. You only get one go at accessing the FHSSS.

For First Home Buyers: We recommend speaking to a Financial Advisor if you’re thinking about accessing FHSSS. While the scheme can greatly assist in breaking into the property market, there are drawbacks including the decrease in your super balance, and getting the timing right to ensure you access the tax benefits and avoid costly mistakes.

The 50% temporary decrease in the minimum payment required from account-based pensions will be extended for another 12 months beginning 1 July 2022.

If your client does not need the standard minimum payment from an account-based pension for the next 12 months, as they have for the previous financial year, they can lessen the minimum payment requirements.

| Measure | Who is Expected to Benefit? | How Many Are Expected to Benefit? |

| Low-Income Superannuation Tax Offset | People making less than $37,000 each year | Approximately 3.1 million, including around 1.9 million women |

| Increasing the number of people eligible to claim a tax deduction for personal contributions to superannuation | Self-employed individuals, regardless of their income, and those who do not have access to salary sacrifice. | Approximately 800,000 working Australians. |

| Concessional contributions for catch-up | People with superannuation balances of less than $500,000 whose income varies over time | Around 230,000 people, including those with irregular work, such as women and caregivers |

| Extending the spouse tax offset | Individuals whose spouses make less than $40,000 per year | Approximately 5,000 people with low-income partners. |

While our superannuation system is always changing, changes like this are welcomed as they increase the simplicity of the system, and represent sensible reforms for the sake of more Australians, particularly retirees and low-income earners.

If you are looking into maximising your super fund, want to find out if you should take advantage of one of the programs detailed in this article, or simply need advice in selecting a new super fund, we are here to help. Talk to one of our award-winning superannuation advisors today to get started.