If you’re struggling to save money, you’re not alone.

A worrying report from ME Bank in 2022 found that 1 in 5 or 22% of households have less than $1,000 in cash savings including 11% with less than $100. The report also mentioned that around 25% of single parents dip into their emergency savings!

It can be easy to feel guilty if you’re not saving as much as you want to, but there are some big reasons why saving money is so hard today. Here are 10 of those reasons.

“Let’s use that extra money to book a holiday!”

You might hear this speech more often than not, especially post-COVID-19 when people are back enjoying the outdoors and planning for leisure, especially with enticing promos available. Day trips, long trips, Christmas holidays, you name it!

Spending money at merchants or online is also easier than ever before, thanks to contactless payment technology and the abundance of banks offering credit and debit cards. According to the RBA’s Payment System Report for 2023, In 2022/23, 730 electronic transactions were made per person on average, doubling about 330 transactions a decade earlier. You can easily enter your card details, or worse – save them in your phone or ‘digital wallet’ – and buy anything you want in minutes. The average person can easily make more than 5 card payments in a single day without realising it!

Our solution: either withdraw a set amount of cash from an ATM and use that for your daily spending, or set up a notification to your phone every time money leaves your account. It’s also a great idea to try a budgeting app that is connected to your spending account to track daily expenses and build spending mindfulness.

Other helpful tips: A monthly budget is really vital to organise your income and expenses (and wants vs needs). Having a separate, locked bank account for a particular savings goal (such as a holiday or a new car) is a great trick to control your progress towards the goal.

Saving money is hard.

One of the most common reasons is that you might not have a good enough reason to save. Maybe you’re overly focused on the present, or maybe you simply don’t know what you want in the future. Either way, you need to get a vision for what you want to achieve with your money.

To start creating your savings plan, ask yourself:

Once you’ve answered these questions, your planning and organising can start. Dig into setting some goals, and identifying your short-term, medium-term, and long-term priorities. Identify which ones you can achieve quickly and which will take more time. For example, paying off credit card debt in 6 months is a short-term goal, while buying a home in 5 years is a mid-term goal.

Our Solution: Choose one primary goal or big reason for you to save money, and use that to drive your commitment to putting aside some cash every week. Make it emotional – your ‘why’ should be about what really matters to you, and your money should support that.

For one, you might be completely unaware of just how many direct debits you’re making every month! Let’s do a simple check: do you relate to any of the below?

Have more than one tick? Keep reading!

I recently went through my bank account and discovered I was paying a monthly direct debit for a magazine that was still being sent to my old address – immediately I unsubscribed! We actually speak to many clients who earn high salaries but never have anything to save; when you earn more than enough, it can be particularly easy to fall into this spending trap.

Our Solution: Review your bank statements and audit your direct debits. Cut out any unnecessary payments that you’re no longer using (or aren’t worth holding back your financial success for)! If that extra subscription service or membership isn’t life-changing, then I’m sure you’d rather put that extra money into saving for your future. We also mentioned this one already, but a budgeting app that tracks your expenses makes it a lot easier to spot any direct debits that sneak through the cracks.

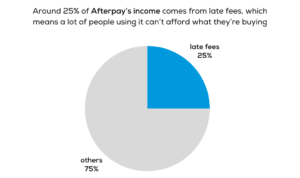

Many people have it drilled into them that if you have a lot of savings, you’re not doing it right. FOMO (the fear of missing out) is huge at the moment, encouraged by social media and the constant advertising everywhere you look. The emergence of buy-now-pay-later (BNPL) schemes like Afterpay strongly encourages the ‘treat yo-self’ attitude.

The Buy Now, Pay Later industry is projected to grow at a steady pace in Australia. Inflation continues to drive more shoppers towards flexible payment schemes, and the trend is much higher among younger generation shoppers.

This report from the RBA revealed that 40% of Australian shoppers aged 18 to 39, are using BNPL schemes. In fact, up to November 2023, a third of Australians over 18 have used a BNPL payment method.

To target higher merchandise volume (and more people), BNPL firms are entering into more traditional shopping as well. While BNPL promotes convenience, you need to be careful you aren’t committing to more payments than you can afford. You should also be aware that BNPL debts can affect home loans or other loan applications!

Our Solution: Using a budget and savings accounts is your first line of defence against spending too much. However, if you use BNPL and struggle to pay your bills on time, we recommend that you stop using it at least for now. Commit to spending only what you can afford now, and this will help protect your credit score as well. Practice discipline and willpower and it will get stronger.

Lots of people are debating whether this is actually as bad as it seems, but for most Australians, we have definitely felt the change (and lack of change!) in our hip pockets in the last couple of years.

In fact, prices have been rising for as long as we’ve been around: in June 2023, premium fuel reached 222 cents per litre, but back in 2001, you’d pay just 89 cents per litre. That’s almost twice as much for a tank of fuel over 20 years. Inflation happens both slowly and rapidly, and one of the issues recently is that wage growth hasn’t kept up with inflation.

The rising cost of goods and services due to inflation makes it harder to save money. As prices increase, your purchasing power decreases. But now for the good news: the Australian Human Resources Institute’s March outlook reported that wages excluding bonuses are expected to increase by 3.7% in the 12 months to January 2025. Inflation also continues to moderate, and is expected to return to 2-3% by 2025.

Our Solution: There are two valuable things you can do to improve your cash flow, and your savings. First, think about increasing your income. When was the last time you asked for a pay rise? Review your options, and if you can’t ask for a payrise, maybe you’ve got a talent that you could turn into a side-hustle? It’s easy to underestimate the value of another $500 or $1000 a month, but it can make all the difference to your budget and your savings.

Second, forget about keeping up with the Joneses! It’s time to cut your personal cost of living. There are lots of ways to do this across the different expense categories, so don’t be afraid to look for bargains or shop differently than before. My advice is to reduce expenses while finding a balance with a lifestyle you can enjoy, but it is worth the effort to do so. We’ve compiled a list of ideas below for you to use creative ways to curb your spending:

👉🏻Groceries <- Choose cheaper ‘store brands’, review and compare sale prices, or try a different store than usual. Many Australians are having success with buying fruit and vegetables at farmer’s markets, through boxed ‘direct to door’ services, or by switching to bulk shopping stores.

👉🏻Household Products & Clothing – Consider buying second-hand or thrift shopping – as a bonus you get the thrill of the hunt and it’s much better for the environment. Got a cute knit jumper you like? DIY it! Learning to sew or knit can be another fun way of stocking your wardrobe with stylish items on a budget.

👉🏻Utilities – Electricity, water, and gas bills can eat up a significant portion of your budget. Try making small changes to your daily habits such as turning off lights, taking shorter showers, or using the air-con or heater for shorter periods. It can also be a quick win to compare different utility providers and switch to a better deal!

👉🏻Housing Expenses – If you have a spare room, consider renting it out to a student. You could look for other opportunities to reduce housing expenses by negotiating lower rent, refinancing your mortgage, or finding ways to save on home maintenance and repairs.

👉🏻Transportation – Consider using public transportation or carpooling instead of driving solo. You could walk or bike for short distances, or even rent your car out when you’re not using it. Review your car insurance premiums against other providers. The costs of a car, and particularly a second vehicle, add up over a year so if you don’t use your car much it might be more practical to sell it.

👉🏻Peer Pressure – If you feel pressure to attend expensive events or buy drinks and dinner, it can be helpful to tell your friends or family about your financial goals. It can be particularly helpful if you can tell a story about what you’re saving for! Suggest alternative, budget-friendly activities, and surround yourself with like-minded individuals who support your efforts to save money.

This is a big killer of budgets. Australians have racked up nearly $18bn of credit card debt in February, with the latest Reserve Bank data revealing worrying signs that households are struggling to pay off their Christmas bill. At the end of February, there were 12.67 million personal credit card accounts, almost 300,000 more than in May last year.

Credit cards put you at risk if you can’t keep up with payments. With an average interest rate of 19%, your debt will rapidly increase if it’s not paid off. Additionally, Experian’s Know Your Score 2019 report reported that your credit score can drop by 22% if you miss just one credit card repayment (even if you never missed any repayments prior) and a massive 42% if you miss three or more repayments within three months.

Our Solution: Be honest with yourself about whether you can pay off your credit bill every month. If you can’t, then a credit card might not be best for you. If you have credit card debt already, it’s important to stop using your credit card until you can get that debt under control.

Credit cards can be a useful tool, but their interest rates are extremely high; the only way to not go backwards financially is to pay it off every month. Use a debit card for everyday purchases and make sure you only spend a budgeted amount on your credit card that you can pay off at the end of the month.

DID YOU KNOW: For credit card repayments, you are considered to have missed a payment if you make the payment more than 14 days late. This can be recorded on your credit report and will stay there for two years. If you are more than 60 days late and the payment is more than $150, then a default may be listed on your report.

It’s not just food and fuel that’s more expensive now. Education and housing are possibly the two biggest expenses you’ll ever have, and both have skyrocketed in price compared to past generations.

University education was free between 1974 and 1989, but the average three-year degree in Australia now costs roughly $50,000, which can take years to repay through the HECS/HELP program. This is technically an interest-free debt indexed at the rate of inflation, but automatic repayments kick in when you earn over $51,550, which can impact your cash flow.

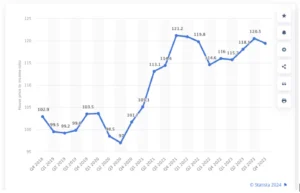

On the housing side, things have taken an upward turn, and not in a good way. The housing cost-to-income ratio peaked in 2021 at 121.2 and continues to be much higher than in the past. This simply means that the cost of housing has risen astronomically in relation to income increases, meaning that affordability has greatly reduced. Rent values have also increased dramatically through 2023: 8.1% in the year to October, and 28.4% since the onset of the pandemic

As of September 2023, saving for a deposit for a home is estimated to take about 10.0 years, with the average 20% deposit around $126,000. This excludes other upfront transaction costs, such as stamp duty.

Income to Housing Cost Ratio

Source: Statista

This increase in entry costs to the housing market is a particular barrier for first-home buyers, while those who own homes have been squeezed by the rise in interest rates. I’m sure you’ve heard of and have maybe even experienced the housing woes Australia is currently facing. This impacts how much you have available to spare for saving, particularly if you want to save for a house.

Our Solution: It’s difficult to have a solution for something that is affecting so many Australians so deeply, but ultimately it depends on your goals. If you have ambitions of owning a home, make that your priority. Understand that you are far from alone; many others are also saving up for 10 years before buying.

If you’re struggling to save because your mortgage has increased so much, we suggest getting advice or negotiating your interest rate. If your rent is over 30% of your income and it’s making it tough to keep going, it might be possible for you to get financial assistance. I recommend a free consultation with a financial counsellor or budget adviser.

A ‘lack of willpower’ is one of the biggest reasons that people reference to explain not sticking to their financial resolutions. And this can be true – if you’re relying on willpower, you might find that you are not getting the results you seek.

Saving money can be hard, and budgeting is difficult for many of us! Much of this is based on your mindset and beliefs around saving and money. Additionally, most of us are trying to do it all on our own, without someone who can keep us accountable or check in on our progress. It’s a little bit like getting fit – it can be much easier when you’re doing it with a personal trainer or even a friend.

Consider what your mindset is towards money and saving. Do you see money as a tool to look good to others? Do you think that money is for spending, or believe that having too much money is greedy or is going to make life more complicated? Your subconscious beliefs, and particularly your family’s approach to money when you were growing up, can dictate your money mindset and what’s holding you back.

Our Solution: First, it’s really helpful to have an accountability partner. This could be a friend on the same journey as you, or even a financial adviser or counsellor. This means that you aren’t relying just on your own strength and willpower. You can also dig into your money mindset and why you feel like it’s too hard – you’d be surprised how much of this comes from your way of thinking!

Finally, we recommend taking as much of it out of your hands as you can. ‘Pay yourself first’ with an automatic transfer to one or more savings accounts and you won’t even have to think about it.

Many people make the mistake of sitting on their cash instead of investing it. If you think you can save big by parking your money in a high-yield savings account, you might be mistaken.

Interest rates on cash options – savings accounts and term deposits – have increased, but not enough to contend with inflation. If you also factor in tax on interest, you are possibly losing money. Savings accounts aren’t all bad – they’re good vehicles for practising good savings habits and are ideal for short-term savings goals. Just don’t rely on them to earn large returns over time.

Our Solution: To combat the effects of inflation, it’s a good idea to invest some of your savings, except your emergency fund, in stable investment options such as index funds or ETFs. These are excellent to get started with, and we recommend using a technique called dollar-cost-averaging: investing a set amount regularly without the need to ‘time the market’. This technique also helps you avoid the emotional rollercoaster that can hurt your investment returns. Investing always has some risk, but it is a long-term strategy (think 10 years minimum). You can also focus on growing your income through career advancement, additional education or training, starting a side business or other wealth-building strategies.

Knowledge is power. This saying applies to your finances. When you know how something works, you can make better and maybe wiser decisions. The question is, how do you know what you don’t know?

How do you free up additional cash to put away, or find all the deals to transform your finances? Some of the things you hear or read may not always be accurate, so it’s important to break through the clutter of information and filter what is helpful. I recommend not trying to find the quick fix, the get-rich-quick scheme. For most people, the best way is the simplest and safest.

You also have to be aware that your brain chemistry might be trying to work against you. Lots of us deal with our reward systems getting all happy when we buy something (even if the dopamine high wears off pretty quickly).

Our solution: Start with as much as you can spare automatically transferred into that bank account we talked about earlier. The more you save there, the better you’ll get at it. And then, every month, try and put a little more into that account. Doing it this way reduces that feeling of burden and stress around changing your money behaviours.

You can start to see the increasing balance in your savings as its own reward or use a reward tool such as a visual tracker on your fridge or a treat that you enjoy when you hit each savings milestone. Just make sure you set your next milestone so you don’t lose momentum!

Then, when you’re ready, you can research techniques and deals offered that can help free up cash. This could be negotiating your mortgage interest rate, switching to a new service provider (or negotiating a discount for not leaving), or figuring out your grocery technique (app vs online ordering vs in-store deals?).

I want to encourage you – it is possible to change your savings habits. And while saving is certainly difficult when you don’t have much to spare after bills and expenses, even a small amount counts. It adds up over time, and you’ll increase your financial fitness with each rep, or deposit in your savings account!

Don’t settle for ‘it’s too hard’: for most of us, savings is the first step to a stronger and clearer financial future. Find out if you’re ready to see a financial advisor, or call our office if you’re interested in getting help.