Let’s say for a moment that you’re not a runner.

But, you decide you want to change that in the most dramatic way possible – you’re going to run a marathon.

What’s next? Do you just wait for the day to arrive, collect your bib, and line up to pound the pavement for 42 kilometres, without having done anything to prepare?

You’re way smarter than that – you’d get into training and make sure you had the steps (pardon the pun) in place to feel great when you finally line up at that start line!

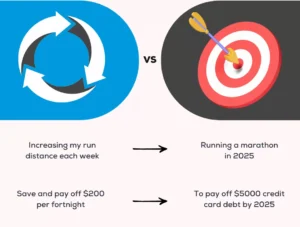

Setting financial goals is pretty similar to training for a marathon. You have your ultimate goal – but often it’s way too big to go straight there. You have to set goals in between to get closer and closer – 5ks, 10ks, 15ks. And finally, all that training pays off.

Let’s face it: failing to plan is planning to fail, especially when it comes to your finances.

Living pay-check to pay-check? Sweating at the thought of your retirement? There is no doubt that the cost of living makes things a bit tougher for many of us, but financial goal setting and creating a system to reach them is an essential step to getting back control and achieving your financial milestones.

Personal financial goals are the specific targets you set for yourself. They are what you want to achieve financially, big or small. Financial goals are usually referred to in time increments: short-term, medium-term, and long-term. This is because short term and medium term goals will often set the foundation for achieving your long-term goals, just like reaching your 10k running milestone is an important step to achieving your marathon dream. This could look like a savings goal of $20,000 a year to achieve a medium term goal to buy your dream boat.

| Short Term (under 1 year) | Medium Term (3-5 years) | Long Term (10+ years) |

| Pay off credit card debt | Clear HECS or student loan debt | Have a portfolio that pays my living expenses |

| Save for a birthday trip or a cruise | Save for a deposit for a property or first home | Have a fund to pay for my children’s university fees |

| Save for a concert | Create a passive income stream | Set aside a legacy for inheritance or charity |

| Pay off car loans | Save up to spend 6 months travelling | Pay off mortgage before retirement |

| Build a capsule wardrobe | Build a solid emergency fund of 6 months of living expenses | Have an investment property portfolio |

| Start investing | No financial stress or financial stability | Retirement planning – retire with enough to travel |

Let’s get practical. Grab a pen and paper, and start by writing down your most important goals and why they matter to you. If you’re the creative type, or you find that seeing it is helpful, you could create a simple vision board to help you picture the life you want to be living in 1 year, 5 years, and 10 years.

Remember, your goal is financial but it is also not financial. So if you’re struggling to know what goals to focus on, think about who you want to be and what freedom, clarity, and choice mean to you. What does enjoying today, as well as the future, look like to you?

The hour or two spent on the goal-setting process is never wasted. James Clear, author of Atomic Habits, suggests taking it one hour at a time when working towards those 10-year goals – “How do you work toward the 10-year things? In 1 hour increments.”

Maybe your goal is to afford a weekly date night to keep the romance alive, send your children to private school to provide a better education, pay off credit card debt to improve your credit score, or own a home to create a treasured home base for your family. Knowing your “why” is important to keep you motivated and give you a sense of direction when the going gets tough. Try and recognise yours and write it down – make it an exciting goal! It doesn’t matter if you need a little extra incentive to stick to your plans.

You’ve probably heard of SMART goals. In fact, just the term can be enough to give me flashbacks of university! However, it is a helpful framework to apply for effective goal setting. The SMART structure ensures you’ve given your goal enough detail to make it meaningful. Vague goals are definitely out of fashion – these days the cool kids are setting specific and attainable goals.

SMART stands for specific, measurable, achievable, relevant, and time-bound. Some make it SMARTER by adding two additional steps: evaluate how your goals are progressing, and re-adjust if necessary. We’ve given an example of a SMART financial goal over on our Building Your Financial Plan blog, and you can use the table to evaluate and give shape to each of your goals.

| Specific | Measurable | Achievable | Relevant | Time-bound |

| Choose a goal that is a particular outcome. Don’t choose a feeling or include multiple goals in one. | How will you track progress and measure the success of your goal? How will you know that you achieved it? | Is your goal achievable? What is in place to ensure that this goal is within reach? | How relevant is the goal that you’ve selected to your overall priorities and lifestyle goal? Is this goal an active part of getting you there? | Create a time-frame for your goal for completion. Use your financial forecast to test your goals achievability |

As soon as you know what your goals are, you need to know what is stopping you from reaching them.

This is like recognising that sleeping-in every day is stopping you from training for that marathon. How will the systems and habits you are currently using hold you back, and what new systems will you need to use instead. Facing up to this is difficult, but I promise it is worth it! Getting your biggest financial challenges down on paper can create a fresh start.

Maybe it’s things like not having enough cashflow and so the credit card becomes necessary, maybe it’s that you love expensive French cheeses too much and can’t stop buying them (I don’t blame you!). Maybe you’ve been avoiding looking at your budget or reviewing your expenses because it’s scary to face your spending habits.

Knowing your Achilles heel is an essential first step to getting stronger. Acknowledge it, and set a goal to make it easier for yourself. Treat yourself to a cozy appointment with tea, your favourite music and snacks, and get it done. Put your goals in front of you and review any financial statements, bills, and any budgeting tools you use that you need to. The goal is to identify the areas that are consistently difficult to stay on track or where you struggle the most.

Remember to be honest and comprehensive; this list is for your eyes only. Tools like budgeting apps or expense trackers can be helpful to give you c insights into your spending patterns and financial habits.

This process isn’t just about listing problems; it’s a therapeutic activity that provides clarity and a sense of control over your finances. By facing your financial realities head-on, you empower yourself to make informed decisions that can transform your financial health.

This can also give you valuable insight into other goals you might need to set.

With your dreams and challenges written down, it’s time to prioritise in order of importance.Having financial priorities is absolutely necessary as most people have a finite resource or income stream. Make sure that your efforts are directed towards the most impactful areas first.

Consider these universal factors or financial basics in your goal-setting to improve your long-term financial success.

Now, categorise your money goals into short-term, medium term, and long-term financial goals. Identify which ones you can achieve quickly and which will take more time. A high-priority goal, or a longer-term goal can also be broken down into a smaller goal if that is helpful.

For example, paying off credit card debt in 6 months is a short-term goal, while buying a home in 5 years is a mid-term goal. A long term goal might be a comfortable retirement that enables you to take overseas holidays.

Your timeline will help determine which goals are most important right now, and which ones can wait on the sidelines until you’re ready to focus on them.

It’s also very important to keep your list of goals manageable. While it’s good to have multiple goals in mind, having too many can lead to a lack of focus and difficulty in tracking progress. Start with one primary goal for each time frame to avoid spreading yourself too thin.

True success often requires laser-sharp focus. Paying off your car loan rapidly might come before saving for a house, so you might choose to turn your savings towards your debts for a short period of time. Maybe you prioritise building a university fund for your kids before renovating your house or buying an investment property. Think about your stage of life and what your biggest money goal is. This is where you can direct your funds now to achieve the best result for your overall financial health, within the optimum time-frame.

Achieving your goals will often mean financial sacrifices. While saving for a house deposit, many Australians will cut out take-away meals, or at least gourmet dinners (if you’re planning on buying in Sydney). However, remember to see this as just a phase in your marathon training – soon you’ll be hitting that milestone, and preparing to take down the next one.

Goals by themselves are just that, a word on paper. An idea, not yet real.

As I mentioned earlier, you’ll need to get that system in place to enable you to integrate your goals into your day to day financial life.

I want to encourage you to take your goals and build an action plan, a method, or a system around it to make it happen. Bring it to life by integrating what you need to do into your day to day routine – just like getting up in the morning to run those 2kms.

It might be helpful to read our Building Your Financial Plan blog. You’ll find more there about the next steps. Or if the idea of transforming your financial life feels daunting, find out if you might qualify for some professional planning and financial advice. A financial professional is a bit like a coach; they can do all the calculations for you, forecast your future plans, create your personal system for success, and keep you accountable to stick to it.

Imagine finally achieving being able to run 25 kms non-stop, but you get home and you don’t tell anyone. That would be strange, wouldn’t it! I think it’s really important to recognise your milestones along the way. Notice when your financial willpower is growing and give yourself a pat on the back. Notice when your hard work is paying off and celebrate by seeing yourself as someone who can achieve what they put their mind to, who can achieve big financial goals.

Psychologically, achieving your milestone goals will give you confidence and resilience to keep going. If you focus on where you might have failed, it can hurt your ability to achieve future goals (and leave you feeling pretty bad).

Resolve to give yourself the best chance to succeed, and then recognise those successes. Celebrate those milestones, and let your sense of accomplishment propel you to keep going.

Now that you’ve got a head start on what’s important to you, and a system to ace your training and hit your milestones, I want to encourage you not to get stuck on a particular goal.

The SMART goal framework was updated by a wise person to make it SMARTER. That E for evaluation and R for readjust are very important when we are talking about your life and long-term priorities. Your goal-setting should be an ongoing process that you can tweak as you need to.

Every year, take a step back and make sure the goals that you’re working towards are still relevant and a priority. Life changes, like getting married, divorced, or welcoming a child, can change everything. Even smaller things like getting a pay-rise or having to move house can impact your financial planning significantly. Even though you should see your goals as a long-term part of your life, don’t be afraid to toss out old ones or change your focus when you need to!

I hope this brief trip through financial goal-setting will help you set your own goals. Your overarching goals can be a strong foundation that keeps you on the right path, keeps you motivated through financial difficulties, and ultimately gets you to the finish line.