Dealing with debt can be daunting and stressful. Struggling to manage living expenses while juggling repayments can take a toll on your financial and emotional well-being. However, With a strategic plan and determination, you can pay off debt faster and pave the way to financial stability.

The best debt repayment strategy for you will depend on your individual circumstances and goals.

If you’re motivated to see the amounts due disappear quickly, the snowball method may be a good choice for you. If you’re more interested in saving money in the long run, the avalanche method may be a better option. And if you’re struggling to manage multiple debts, debt consolidation may be a good way to simplify your finances.

In this guide, we’ll walk you through how to choose the right method for you, and how to get started.

Key Takeaways

- Understanding your debt is the first step in paying it off

- Choosing the right strategies for your financial situation can help you pay off debt faster

- Changing your spending habits can help you get out of the debt cycle

What is Debt?

Debt is the amount of money that one person or organisation owes to another. For most people, debt starts when they take out a loan, such as a car loan or student loan, or when they get a credit card.

A loan can be a useful tool when used responsibly. Small businesses can use borrowed funds to expand, buy equipment, hire employees, and enter new markets. Individuals or families can use a loan to purchase their home, or buy the car they need. However, debt can easily become a major burden if it is not managed properly.

Debts come with interest payments, and if you’re not keeping up with your payments, this can add up over time and make it difficult to get out of. If your expenses are more than what you earn, you have to keep borrowing money to maintain your lifestyle or keep purchasing what you need. This is how you can enter a debt cycle, and it can be a difficult cycle to escape. This is why it is so important to keep a close eye on your debt and keep up with your repayments.

The most common types of debt in Australia

It is not uncommon to have debt. Research shows that three in four Australian households had debt. For decades, Australians have been using personal loans to expand their homes, buy new cars, invest in their business and indulge in vacations. But let’s get into the specifics of this borrowing trend.

1. Credit card

Credit cards can be a convenient way to pay for things, things you don’t need and things over budget. When you use a credit card, you are essentially borrowing money from the bank or credit card company. If you don’t pay off the balance in full each month, you will be charged a high interest. This can lead to a cycle of growing debt that can be a difficult habit to break.

2. Personal loans

In 2019, nearly 40% of Australian adults took out personal loans. Of those loans, 20% were for purchasing new cars. The Australian Bureau of Statistics (ABS) confirms that road vehicles make up the largest portion of the personal loan value each month.

Apart from cars, the number of Australians opting for student loans, known as the Higher Education Loan Program (HELP), is increasing. The average student loan debt in Australia is $24,711, with 3 million Australians having student loans. Personal investment is another common form of personal debt in Australia, along with travel and holidays, housing, and business loans. The changing mix of loan purposes reflects the evolving financial priorities of Australians.

3. Payday Loans

Between April 2016 and July 2019, just over 4.7 million individual payday loans were written in Australia. Payday loans are small, short-term loans that can be a quick way to get cash when you need it. However, they come with high fees, which can make them very expensive. The maximum amount you can borrow from a payday lender in Australia is $2,000. For example, a $2,000 payday loan could cost you $400 in establishment fees and $80 in monthly fees.

The good news is, if you can get into debt, then you can get out of it. By cutting spending and paying more than the minimum, you can pay off debt and live a stress-free life.

Why Is It Important To Pay Off Debts Fast

Paying off debt faster will help you save more money in the long run. With interest rates continually increasing, it’s important to pay off your debt as soon as possible so you don’t end up paying more than necessary.

Let’s say you borrow $100 at a 5% interest rate, you will pay $105 in total. The lender will make $5 in profit, which is the interest they charge on the loan.

This might seem like a small amount, but the average interest rate for credit cards in Australia is 19.94% p.a. This means that if you have a balance of $5,000 on your credit card and don’t pay it off for a year, you will owe $5,997. That’s an extra $997 you’ll have to pay just for carrying a balance!

The first step to paying off debt is to understand how much you owe and what the interest rates are. Once you have this information, you can start to create a plan to pay it off.

Understand your Debt

It is important to be aware of how much debt you owe so that you can make informed decisions when it comes to managing your finances. To get a clear picture of your financial obligations, start by listing all of your debts. Include buy now pay later accounts, credit cards, loan repayments, unpaid bills, fines and any other money that is owed.

For each debt item include:

- The balance

- The minimum monthly repayment (if applicable)

- The due date for payment

- The interest rate (if applicable)

Having this information will help you figure out which debts need to be paid off first and what payments you can afford to make each month.

The interest rate is the most important item to consider when paying off debt. Putting the effort in to track the rates of each debt will pay off as you can save a significant amount of money over the life of your loan.

You can also understand your debt by using tools such as the Money Smart Credit Card Calculator. You can use this to estimate and calculate the time it will take to pay off your credit card balance and how much you could save by increasing your payments.

Once you have all your debts and interest rates listed out with their details, you’re ready to choose the method you’d like to use to pay down your debts.

Financial Strategy to Help You Pay Off Your Debt

You can pay off debt faster by cutting back on unnecessary expenses, increasing your income, and creating an effective budget. However, the most important element is mastering your debt repayment strategy. You can adapt your strategy to your personal situation. Below are 3 common strategies to pay your debt fast.

Debt Avalanche Method

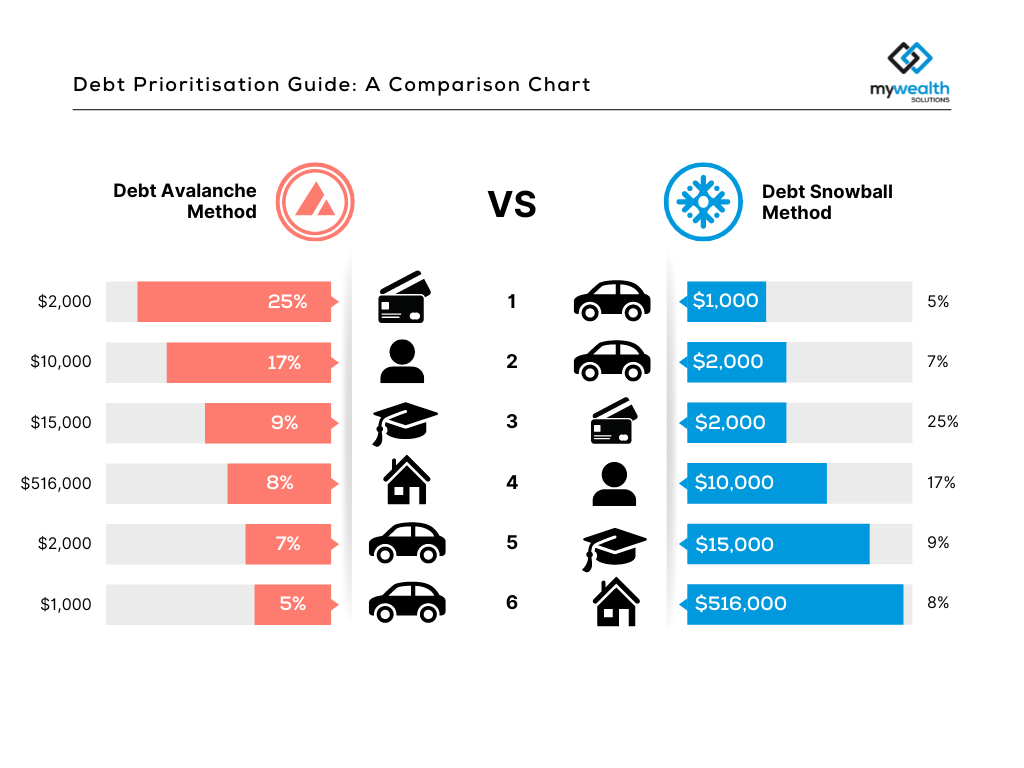

The first strategy is the debt avalanche method. This strategy involves paying off debts with the highest interest rates first, regardless of the size.

How to pay off debt with the Debt Avalanche Method:

- List out debt from highest interest rate to lowest interest rate

- Make minimum monthly payments on all debt, except for the highest interest rate

- Pay extra towards the debt with the highest interest rate

- Once you have paid off debt with the highest interest rates, start paying more on the next highest interest rate

- Repeat until all debt is paid off

This method can save you money in the long run, but it may be more difficult to stick to. The cons of this method are that it may take a while to see a noticeable change in your debt and it also requires discipline and commitment to paying extra to that one debt.

Let’s dive into a practical example to understand how the debt avalanche method works. Imagine a person with various debts, including a $2,000 credit card balance, personal loan, student loan, mortgage and car loan.

With the debt avalanche approach, they would start by prioritising the credit card debt due to its highest interest rate. The first step involves directing their efforts and available funds towards paying off the $2,000 credit card balance aggressively. Meanwhile, they continue making minimum payments on the other debts. Once the credit card debt is completely paid off, they move on to the next debt with the highest interest rate— the personal loans next.

By focusing on debts with higher interest rates first, they effectively reduce the overall interest costs over time. This process continues until all debts are cleared and working their way down to the lowest. By gradually chipping away at each debt, they gain momentum and financial freedom as they gradually eliminate their debt burden.

Debt Snowball Method

The second debt repayment strategy is the debt snowball. This method involves paying off the smallest debt balance first, regardless of the interest rates.

In contrast to the debt avalanche, the debt snowball focuses on paying minimum payments on all debts but allocates extra funds to the smallest debt until it’s fully repaid. The psychological boost from accomplishing smaller milestones can keep you motivated throughout your debt repayment journey.

How to pay off debt with The Snowball Method:

- List out debt from lowest balance to highest balance

- Make minimum payments for all debt except the smallest balance

- Pay extra towards the smallest debt

- When you have paid off the smallest debt, start paying extra towards the next smallest balance

- Repeat until all debt is paid off

Both methods have merits, so consider your financial goals and personal preferences when making a choice. The debt avalanche is mathematically sound, saving you more on interest, while the debt snowball provides emotional rewards and keeps motivation high.

Debt Consolidation Loans

Debt consolidation is the process of taking out a new loan to pay off multiple existing debts.

The pros are that it can:

- Lower your monthly payments: If you have multiple debts with high-interest rates, consolidating your debt can help you lower your monthly payments by combining all of your debts into one loan with a lower interest rate.

- Simplify your finances: Instead of having to make multiple payments each month, you can make just one payment. This can make it easier to budget and track your spending.

- Improve your credit score: If you make all of your debt consolidation loan payments on time, it can help improve your credit score over time. This can make it easier to qualify for other loans or credit cards in the future.

The cons of debt consolidation loans are:

- High fees: Debt consolidation loans can have high fees, such as origination fees, closing costs, and prepayment penalties. These fees can add to the overall cost of the loan.

- Risk of default: If you cannot make the payments on your debt consolidation loan, you could default on the loan. This could damage your credit score and make it more difficult to get approved for any loans in the future.

Debt consolidation is not a magic solution to debt problems. It is important to make sure that you can afford the monthly payments on the debt consolidation loan and that you have a plan to repay the loan in full. It can be a good option for people who are struggling to manage their debt, but it is important to get loan advice before making any financial decisions.

People Also Ask: Should I save or pay off my debt first?

The answer depends on your individual circumstances. If you have a lot of high-interest debt, such as multiple credit card debt, it may be best to focus on paying that off first. This will save you money in the long run.

However, if your debt has a low interest rate, you may want to focus on saving for your future goals or emergency fund instead. If you don’t have an emergency fund yet, consider paying the minimum amount on each debt and start saving for your emergency fund. You can also set up an automatic transfer to a savings account every payday to force yourself to save money for your emergency fund or any other savings goals.

Ultimately, the best way to decide whether to save or pay off debt is to create a budget and track your spending. This will help you see where your money is going and make a financial plan to reach your goals.

How Much Debt is Considered Bad?

If you’re consistently late paying bills, because you can’t afford them, it’s a sign that your debt is getting out of control. Similarly, if you’re consistently withdrawing from emergency funds, savings or using a credit card to cover bills, you need to reassess your finances.

Here are some signs that your debt is getting out of control:

- You’re spending more than you earn each month

- You’re carrying a balance on your credit cards each month

- You’re making minimum payments on your debts

- You’re feeling stressed about your finances

- You’re considering declaring bankruptcy (It should be considered a last resort, as it can have a negative impact on your future)

If you are struggling to make your debt payments, or if your debt is causing you financial hardship, you should take action now before it spirals further. However, not all debt is bad, as some debt can help you grow your wealth and help reduce your tax burden. If you’re interested in learning how to turn bad debt into good debt, talk to our advisors today.

Services to Help with Debt

There are a number of services available to help if you’re dealing with debt and want to make a change. These services are:

- Financial Counselling: A financial counsellor can help you create a budget, develop a debt repayment plan, give financial advice, and teach you how to manage your money more effectively. The National Debt Helpline 1800 007 007 is a free service that provides Australia-trained counsellors to help you navigate and create a plan to stay on track. You can also speak to services such as Beyond Debt, who can assist you with taking control of runaway debt.

- Budget Services: There are affordable services to assist you with budgeting or sticking to a budget such as My Budget. If you’re ready for financial advice, our financial planners can also assist with creating a money management strategy detailing your cash flow, budget and debt strategies.

- Debt Negotiation: This is the process of negotiating with your creditors to lower your interest rates, lower your monthly payment, or to remove late fees. It is not a guaranteed way to reduce your debt, but it can be worth trying if you are struggling to make your payments.

- Debt Settlement: This is the process of trying to get your creditors to agree to accept less than the full amount you owe. This can be a risky option, as it can damage your credit score and make it more difficult to get loans in the future. However, it can be a viable option if you are unable to make your payments and are facing bankruptcy.

- Debt Recycling: A financial advisor can help you in this strategy. Debt recycling is a process that allows you to use the equity in your home to invest in income-producing assets, such as shares or investment property. Debt recycling is most beneficial for people who have a lot of equity in their homes and who are able to make regular investments.

How To Change Your Spending Habits

At this point, you probably have a strategy in mind about how to pay off your existing debts.

But it is also important to consider the reasons behind how your debts have accumulated. Is it coming from significant purchases such as a car or a house? Is it from smaller expenses like a new pair of sneakers, golf clubs, or a holiday? Is it from keeping up with daily expenses and groceries due to a rising cost of living?

Understanding where your debt is coming from is key to knowing what you need to change in the future.

As you go through your spending habits, you will likely become more aware of them. It’s easy to get into a routine of spending money on small luxuries or conveniences without really thinking about it. Most people have at least one thing or area where they are overspending—for some people, this means cutting back on little luxuries like morning coffees and others may benefit from creating a grocery list before shopping and sticking to only essential purchases. Of course, making sure you’re using your money to enjoy life is important too, but if you’re dealing with debt, it is helpful to decide on your priorities.

The power of budgeting

Using bank statements and other records, list all your ‘Fixed expenses’. Review your bank statements to get the exact amounts! This includes rent or mortgage payments, car loan payments and car registration, credit card payments, mobile phone or internet, insurances and utility bills, and school fees. These create a foundation for your cost of living and often will be a big chunk of your income.

Now, write down your ‘variable expenses’ – it can be helpful to use the average amount as a baseline. These might include fuelling up (or charging) your car, groceries, entertainment or eating at restaurants. As part of your expenses, list down every single subscription or membership that you pay for. It might take some digging but don’t hold back.

After you’ve done this, categorise your expenses into ‘wants and needs’, and overlay your debt list. Using your chosen strategy, calculate where you can take money from your ‘wants’ or even if you can revisit and reduce your ‘needs’ (can you get a better internet plan? Can you renegotiate your mortgage interest rates?) and put that extra money towards your highest priority debt.

Making small changes in your spending and budgeting can help you save money in the short-term but more importantly it can take control of debt and prevent additional debt in the future.

Stay Disciplined and Patient

Debt repayment is a journey that requires discipline and patience. Stay committed to your plan, and remember that progress may not always be immediate, but every step counts towards your ultimate goal.

Debt Budgeting Tools

Conclusion

Overcoming debt may seem like an uphill battle, but with the right strategies and mindset, it’s undoubtedly achievable.

When you can honestly assess your debts, seek expert advice, and create a budget that prioritises repayments, the rest starts to fall into place.

The debt avalanche and debt snowball methods offer distinct approaches, each with its advantages. Consolidating loans or speaking with a debt counsellor for support are also good strategies. No matter which method you choose, the most important thing is to create a plan and stick to it.

Don’t bury your head in the sand when it comes to debt; instead, take proactive steps towards conquering it with knowledge and planning.

If you’re interested in getting financial advice on your situation, read our guide on when a financial advisor can best help you!