Life is short, money doesn’t seem to hang around for very long, and you need to know the right choice to build your wealth right here and now. The ongoing debate of shares versus property has vocal advocates on each side, but which one is the better investment option for you?

In this guide, I’ll examine each investment type on several important factors. I’ll compare the benefits and disadvantages so you can make your decision based on what you’re looking for in an investment. You’ll also find the case study I’ve shared helpful in considering how shares and property can work together in a well-diversified portfolio.

Investing is an essential part of any successful wealth creation plan. Let’s cut through the noise to get the answers you need to get started.

I’ll be covering:

There could be a number of reasons why you are interested in investing, including:

When planning out investment strategies for my clients, I always start by identifying your financial and lifestyle goals and what you want to achieve by investing. It’s also important to know when you want (or need) to start seeing the fruits of your labour; ie the returns. Deciding on these two things is critical to making the right personal choice for you. The final thing that can determine your initial decision is how much cash flow you have available to invest.

What we want to do is measure up the outcomes of shares vs property with your financial position and goals. Ultimately you can’t directly compare shares and property as they are incredibly different asset types that respond to economic change very differently, but you will be able to decide which would work best for you. Remember, depending on the strategy you take, you can achieve very different outcomes even within each type.

As a financial advisor, I don’t have a bias towards either shares or property, so I won’t try and push you towards one or the other. I frequently include either, or both, in my clients’ entire investment portfolio, whatever suits their personal circumstances best.

Both property and shares can belong in short and long term investment strategies. As a rule-of-thumb, angling for short-term profit is riskier and more labour-intensive than pursuing long-term growth.

Property is most often a long-term investment, and as such it can support your wealth strategies over many years with rental yields, tax benefits, and capital growth that can provide a source of equity to drive other strategies such as debt recycling.

Property can be a short term investment if you are using strategies such as ‘flipping’, where you increase an older property’s value to earn a profit. Another risky short-term strategy is purchasing in an area that is expected to experience growth, with the aim to sell once the value increases.

Short term investing in shares involves ‘timing the market’, and requires active trading to buy low and sell high. This can take the form of day trading or other short term investment strategies which are extremely risky and demands substantial time and research.

Long-term investments benefit from compounding returns over many years, enabling effective risk management and strategy adjustments as your portfolio grows. You could start with a more aggressive investment strategy, and switch to a more moderate approach once you’ve built a strong portfolio. This approach is often more passive, relying on broader market factors for growth.

My takeaway: Both can be used short or long term, but short-term investing comes with considerable risk in both cases.

Historically, Australian property, especially in capital cities, has shown a strong return on investment. Over the 20 years to 2017, Russell Investments reported that residential property was the top performing asset class overall at 10.2%, followed by Australian shares at 8.8%.

Yet, overall, the share market tends to outperform the property market. Why? Shares offer greater growth potential due to fewer limitations on growth, much lower buy-in costs, higher liquidity, and lack of geographical restrictions. These factors ensure that shares edge out property for overall rate of return.

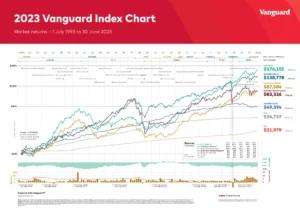

The 2023 Index Chart by Vanguard provides a nuanced view on returns over time. We can identify the ebbs and flows between investment types from 1993 to 2023, with Australian property providing 7.3% in annual returns, while Australian Shares returned 9.2%, and US Shares returned 10%. Now past results are no guarantee of future performance, but we can see the general trajectory that the Australian stock market has taken.

Although property values generally increase over time, cycles of growth and decline impact its consistency. Geography also plays a big part in growth, and there are many geographic areas where values are stagnant.

So just purchasing an investment property doesn’t mean that it will be a good investment or that it will provide you with better returns than the share market. Success in property has a lot to do with the skill of the property investor. However, you do have more control over the profits you can get of real estate. You can influence returns by making improvements or renovations, and you can also more easily predict the broader property supply and demand trends.

The share market is far more volatile than the property market, with prices fluctuating daily. Shares are constantly being bought and sold, and their prices are transparent. Buyers and sellers know the exact current value, which is affected by a number of factors, including company performance, and external political and economic conditions which share investors have no control over. Significant share market dips can concern investors and drive bigger economic trends.

My Takeaway: Both asset types have generated excellent returns on investment over time, with the share market edging out property for year-on-year capital growth.

Ok, ‘passive income’ isn’t really a thing – you still have to do some level of work for it! I’m using the term to refer to the income generated from holding investments.

Rental yields are the primary source of property income. They can help cover your property’s mortgage payments, which means less drain on your personal income. Typically, higher rental yields imply greater risk. However, the hidden cash-flow benefit is that rental returns can increase over time while what you paid for the property does not.

On the other hand, owning shares generates income through dividends, which are payments that shareholders receive when the company makes a profit. Dividend percentages can vary between businesses, ETFs (Exchange-traded funds) or mutual funds.

You could tailor your property choice towards rental yields or capital growth, just as you can select shares for portfolio value or attractive dividend percentages. Timing makes all the difference in deciding which option is best. Buying rental properties demands a higher capital outlay, and while rental income can be immediate, it is ‘capped’ and you’ll have ongoing costs.

To generate significant dividends, you’ll have to hold a lot of shares. For instance, with a 4% dividend yield, a $300,000 investment is required to generate about $1,000 a month ($12,000 a year). So if you invest the cost of a property into dividend-producing stocks, you can achieve similar or greater returns than rental yields.

My Takeaway: Property edges out shares in terms of immediate income, however with time to grow, a well-structured share portfolio will generate more income through dividends.

Property requires a significant amount of upfront capital, both in the form of a deposit and in your ability to service a loan (and manage the fluctuation of interest rates). The difficulty in generating this initial investment capital is a source of financial stress for many Australians, which restricts them from building wealth through property. As well as high property prices, additional costs like building inspections, stamp duty, and ongoing maintenance or property management further add to the expenses.

Shares are an investment option which requires much less initial capital to get started. Some apps, such as Raiz, allow you to start with small everyday transactions and loose change. While investing in shares involves transaction costs or percentage fees, they are usually relative to the amount of money you are investing. You can also research to find the brokerage or platform that you’re most happy with in terms of fees.

My Takeaway: Shares are the clear winner on upfront costs and the expense of getting started.

Depending on your strategy, shares can require a little or a lot of time. Riskier strategies such as ‘timing the market’, or day-trading require extensive research and frequent trading. In contrast, less volatile strategies such as dollar-cost-averaging, ‘buckets’, or index funds can yield profitable results without needing day-to-day management. Of course, both approaches involve risk and need to be researched.

Unlike shares, property is a tangible asset that requires hands-on maintenance over time. Properties can deteriorate, become outdated, or get damaged. And because generating a profit from an investment property is usually a long-term endeavour, you’ll encounter extra maintenance, property management issues, and vacancy periods.

My Takeaway: Shares are the winner on time and effort expended if you choose a long-term or more ‘passive’ strategy like index funds and ETFs.

You’ve heard, ‘Don’t put all your eggs in one basket’. That’s the heart of a diversified portfolio. Some people don’t agree with this, but ultimately it is a wisdom principle that is best applied to your investments for two reasons: it creates a portfolio that is less risky and more resilient, and you’ll be able to get a variety of benefits and returns. A truly diversified portfolio will have a variety of asset classes including both real estate and shares.

Shares are highly liquid assets, accessible online, and offering a wide variety of industries, geographical regions, and types of shares (stocks, bonds, ETFs, mutual funds). You can also diversify based on share prices or dividend percentages. This makes it very easy to build a diversified portfolio of share investments.

In contrast, property is a tangible, geographically-limited asset that is impacted by local and national market fluctuations. Relying only on real estate investment can be risky. A downturn in property demand, town-planning issues, a lack of tenants, or other unforeseen events can devalue your entire portfolio.

Building a diversified portfolio of properties across residential or commercial properties, or across different geographic areas, requires considerable capital investment which can make it less accessible.

My Takeaway: Shares win in the ability to easily diversify, but a truly diversified portfolio includes both tangible and intangible assets (shares & property).

As shares are an intangible asset that is part of a larger company, they offer a lot more flexibility for buying and selling. Their flexible nature allows you to adjust your portfolio size and structure at will, without having to sell your entire portfolio. Shares are also very liquid, almost as much as cash, and they can be sold and converted into cash in emergencies quickly and easily, thanks to active share markets.

Property, as a physical asset, simply can’t offer this level of flexibility and liquidity. It can’t really be divided up into pieces or ‘partially’ sold. Property sales also take significant time, effort, and additional costs.

My Takeaway: Shares are much more flexible and liquid than property.

Both shares and property can offer tax benefits.

For shares, the primary tax benefit is franking credits, which provide a tax rebate on your dividends, preventing profits in Australian companies from being double-taxed. However, proposed policy changes might alter the franking credits scheme.

Investment property, when negatively geared (generating less income than the interest and maintenance costs), allows you to reduce tax payable. Losses can be claimed to offset your tax liability, and maintenance costs and depreciation can be deducted as your property ages. Indeed losses across both shares and property investments can be used to balance the impact of capital gains tax on your profits.

It’s possible to leverage property more effectively than a share portfolio. One of the strategies I use with clients is called debt recycling, where we draw on the equity of the property and take out a tax-deductible investment loan. We then use the ‘income’ from the investment and tax savings to increase mortgage repayments on ‘bad debt’. As purchasing your property requires a significant initial investment, this can allow you to access additional capital to use for wealth generation.

My Takeaway: Property wins here as the tax benefits are greater and are more useful across your overall financial strategy and wealth creation.

Shares are well-known for their volatile nature, influenced by investor behaviour, news, events, and real or perceived company-specific risks. While this volatility is real, many investors focus more on the long-term, where markets tend to bounce back from downturns, and growth investments build steadily. However, risk increases if you’re an active investor who is ‘timing the market’ for short term gains, or investing in individual stocks with high volatility.

Ben Budge, one of our Directors and a seasoned Financial Advisor, had this to say:

“While it can be disconcerting to see the value of your share portfolio rise and fall on a daily basis, keep your long-term investment goals in mind and you won’t have to worry about the daily prices as you’re not planning on selling.”

On the other hand, property is not considered to be volatile and doesn’t usually experience rapid, unpredictable price swings. Indeed, property in Australia has had a golden run with very few losses over the years. However, there is still substantial risk associated if you make a poor property choice and don’t generate the yields you need, or you overextend yourself and you struggle to meet the loan requirements. Given the large individual expense of real estate, if it goes wrong it can set your financial strategy back by years.

My Takeaway: Shares are more volatile and risky than property, but property has significant risk if you’re not wise about where and what you purchase.

One of the biggest challenges in the argument between property vs shares is whether tangible or intangible assets are a better investment choice.

Property is tangible; you can see, touch and occupy it. It exists in a physical place and provides a sense of ownership and comfort. However, it’s also subject to wear and ageing, and requires constant maintenance – I definitely get tired of mowing my lawn in the summer! These additional expenses can eat into your returns.

Shares are intangible. You can’t touch them or take them home. They only exist in digital or paper form. You’re a silent investor: you can’t influence how your individual share performs, and you’re at the mercy of the business’s decisions or the market. On the positive side, shares require no maintenance to yield a profitable return on investment.

My Takeaway: Property is more tangible than shares, and you have more control. However, that doesn’t eliminate the possibility of poor investments and financial risk.

We’ve gone through a significant amount of factors to consider in building your portfolio. Let’s recap with our top performers in each area:

| Pros | Cons | |

| Property |

|

|

| Shares |

|

|

I’ve talked through a lot of the comparisons with property and shares in this article, but ultimately how they create value for your unique financial circumstances depends on which strategies you use, your investment style or what type of investor you want to be, as well as your risk tolerance. I recommend you speak to a professional if you are interested in developing a personalised strategy.

As we discussed, your success in property investment comes down to your financial objectives and in a really big way, the location. I usually look at the following filters when we discuss property purchases:

It can depend on your financial situation and strategy, but I usually recommend:

Negative gearing is when the rental return from your investment is less than your interest repayments and expenses. This strategy is used to reduce taxable income by claiming your expenses (and the interest on your loan) as deductions.

This involves using the equity in your family home to purchase your first investment property. You can then leverage the equity in your investment property to expand your portfolio. But be careful not to overextend yourself, as interest rate changes or an inability to service your loans can impact your financial security.

Property is a popular investment option for those with Self-Managed Super Funds. Property is a stable and tangible asset and provides a less risky alternative than other common SMSF investment options such as gold or vintage cars.

This is one of the simplest ways to invest effectively in shares without ‘timing the market’. A long-term strategy, it involves investing a set amount at regular intervals, without caring if the market is up or down. Over time, your investment balances out as you stay in the market consistently through both ups and downs.

Active Investing is a very hands-on approach, usually buying and selling based on how the market is operating. You need some expertise to manage this with any success, with the aim to beat the average returns. An active approach is usually looking for short-term gains over and over again. It’s also important to be aware that frequent trading results in higher transaction fees.

Passive investing is essentially a long-term strategy. Passive investors usually use a ‘buy and hold’ strategy where they select the stocks they want to purchase and simply hold them for a long period of time. This could look like individual stocks, or index funds or ETFs that follow a major index. Passive investing has outperformed active investing in many cases.

Our CARE Investment Philosophy is how we approach investing for our clients. Essentially, it is a ‘buckets’ approach, where a Core portion is allocated to a well-diversified portfolio that grows long-term, an Active portion, where money is moved in and out based on the market troughs (buying low), a Reserve of highly liquid investments, and an Enhanced bucket of blue-chip stocks that produce tax-efficient income. This combination method works very well for our clients.

As investment assets, both property and shares have their positives and downsides. As we can see, each one can be used to enhance a wealth-generating portfolio. If you are able to use both on your investment journey, you can maximise your short and long-term position while enhancing your ability to generate return on investment. You can leverage both to some extent for tax efficiencies including leveraging equity and balancing capital gains. Importantly, it also provides you access to diverse areas of the market which is powerful through economic ups and downs.

Deciding on which one is the right investment type for you to focus on right now depends on how much money you have to spare, how comfortable you are with risk and how much longer you’ll be in the workforce. The right investment strategy for you should be built around your unique financial position and short, medium and long-term goals.

If you’d like guidance on creating long-term wealth through your own investment strategy, contact our team of financial advisers today.