You’ve found yourself asking a big question – perhaps one of the biggest financial questions of your life – “How much do I need to retire?” According to Vanguard’s How Australia Retires survey, half of Australians think they’ll run out of money in retirement.

Moneysmart suggests aiming for around 67% of your current annual income to maintain your lifestyle in retirement.

ASFA estimates you’d need a lump sum of around $100,000 for a modest retirement. For a comfortable retirement, aim for a lump sum of at least $595,000 for a single person and $690,000 for a couple (these figures are for incomes that are supplemented with the whole or part age pension).

Are you on track with your superannuation savings? Most people at the age of 30 have between $107,000 and $76,000, which rises to $136,000 – $219,300 at the age of 50.

Your ideal retirement is unique, so coming up with an exact figure depends on your current finances and the type of retirement lifestyle you’re hoping for.

Our team has answered this common question for over 1000 clients over the last 10 years and I’ve pulled that knowledge together into this practical guide.

As you imagine and plan for your retirement, think about what you’d like to do during those years. Perhaps you’d like to slow down and stay close to home, or maybe you’d love to travel, start a new hobby or play sport. These priorities and ideas can help shape your retirement budget. If you’re accustomed to a certain standard of living, you’ll need to assess if that is still sustainable during retirement.

The difference between modest and comfortable is about $25,000 a year.

The Association of Superannuation Funds Australia (ASFA) provides a Retirement Standard to gauge how far your money will go in retirement. This standard, updated to March 2024, takes into account the increase in the cost of living.

A couple, aspiring to lead a comfortable lifestyle, will require $72,663.00 annual income in retirement, assuming they own their own home.

A couple aiming for a modest post-work life should budget $47,387.00 per year. It can be very difficult to make ends meet on the age pension – poverty in retirement is a real problem for 22% of Australian retirees – so building up even a modest nest egg is important.

The chart below provides a handy reference to look at different retirement spending levels.

AFSA Retirement Standard 2023

| Lifestyle Expenses | Age Pension | Modest Retirement | Comfortable Retirement |

| Annual – Couples Annual – Singles | $41,704 $27,664 | $45,946.62 $31,867.31 | $70,806.43 $50,207.02 |

| Weekly – Couples Weekly – Singles | $802 $532 | $883.58 $612.83 | $1,361.66 $965.51 |

| Travel | Limited to 1 short break or local day trips | 1-2 short breaks near your home | Annual domestic holiday & occasional overseas trip |

| Groceries & Dining Out | Limited to Grocery budget, discount meals or inexpensive takeaways | Average range & quality of groceries Infrequent dining out | Good range and quality of groceries Frequent dining out |

| Leisure Activities | Low cost or no cost activities. Infrequent trips to cinema | Can partake in some paid leisure activities | Able to regularly participate in paid leisure activities & cinema trips |

| Car Ownership | Limited budget to own, maintain or repair a car | Likely to own a cheap & older car, can afford basic level of repairs | Able to afford / maintain a reasonable car and insurance |

| Home Improvements | No budget for home maintenance and repairs | Budget for home repairs but not improvements | Can repair home including replace kitchen and bathroom over 20 years |

| Clothing | Basic clothing | Basic clothing | Good clothing |

| Alcohol | Limited | Regular, mostly cheap cask wine or beer | Regular good wine & beer |

| Personal Care | Less frequent haircuts & discount personal care | Regular haircuts at basic salon | Afford regular haircuts |

| Home Appliances | Less heating in winter / cooling in summer | Not likely to be able to afford air conditioning | A range of electronic appliances owned and used |

| Health Insurance | No private health insurance. Public health system support only | Basic private health insurance, limited gap payments | Top level private health insurance, doctor/specialist visits, pharmacy needs |

In setting your retirement lifestyle expectations, you should evaluate your current spending habits. Even if you don’t stick to a strict budget now, you should consider:

Starting with your existing expenses will help you identify your ‘minimum lifestyle requirements’, and can alert you to ways that you are spending that may not align with your goals. As Ramit Sethi advises in I Will Teach You To Be Rich, “Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.” This can be particularly true in retirement!

As we mentioned earlier, the standard is 67% of your current annual income is required for the same lifestyle in retirement. For example, if your current income is $120,000, 67% is $80,400; if your current income is $65,000, it’s $43,550. Keep in mind this calculation does not include inflation.

Use this planning phase as an opportunity to shake up your old ways of doing things. Many elderly people talk about regretting not living their own life, not enjoying the moment, or chasing the wrong things, according to Inc. The freedom of not having to work means that you can focus on what really matters to you. Try and incorporate this into your planning now, so you’re both emotionally and financially prepared.

You might be wondering ‘how can I maintain my current lifestyle on 33% less income?’. This is because, by retirement age, most people will have paid off their mortgage or other debts, and no longer need to put money aside into superannuation. Your income is tax-free, and you might also be receiving the age pension. Not to mention that discounts are one of the perks of being called a senior!

AFSA research has also found that as you age, your opportunities to spend diminish. You’re less likely to want, or need, to splurge on holidays, entertainment or home and car maintenance.

Moneysmart provides super savings targets for singles and couples. For example, couples planning to retire between the ages of 55-59, with the retirement goal to live on $87,000 a year, will need to achieve a superannuation balance of $1,037,000.

Those who are aiming for an annual retirement income of $69,000 as a couple, will need to save a much more achievable $425,000 super balance. Keep in mind these figures assume you own your own home ( housing costs such as rent or mortgage repayments would affect the amount of financial resources you need to have available)

A simple rule of thumb suggests aiming for around two-thirds of your current income (or that 67% annually), to maintain your lifestyle in retirement.

You can tailor your retirement savings target more closely to your unique situation or goals by using a super projection calculator or retirement calculator (keep in mind the calculators provided by super funds can be inaccurate!) These are just estimates however, as many variables could impact your figures, such as:

Inflation can have a significant impact on your retirement savings by reducing the purchasing power of your money over time. When your money doesn’t stretch as far, you need to draw more out of your super fund each year. If you rely on a fixed source of income, you may need to reduce your budget to accommodate for the rising cost of living.

In order to combat the effects of inflation, it’s recommended that you hold a diversified portfolio, for example equities, real estate investments such as REITs, or international bonds. These can mitigate the effects of inflation by continuing to provide returns. Talk to a professional financial adviser to help you create the right strategy for your financial situation.

If you start planning now, your timeline to retirement can make a big difference to your retirement budget.

The earlier you start saving, the more likely you are to reach your retirement savings goal, while the earlier you leave the workforce, the longer your superannuation will need to last.

Preservation age, or when you can access your super tax-free, is 55-60 (depending on your date of birth). How long you have left in the workforce can help you decide how to best use the time you have.

For example, some people delay their retirement in order to pay off their mortgage – they work a few more years to ensure their retirement fund will last longer.

It’s also helpful to understand when you’re eligible for the age pension-usually from the age of 67 for most retirees. Our retirement planning guide goes into this in more detail.

My tip: don’t forget to consider your partner’s retirement plans and if you want to align with them.

If you’re not ready to go straight into gardening, the Transition to Retirement strategy can be a great way of easing into retirement (while keeping super savings flowing).

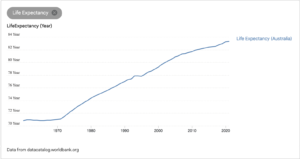

One of the biggest fears of retirees is that their funds won’t last. Life expectancy in Australia has risen by over 10 years since 1970, and continues to rise, and the ABS reports that men can now expect to live to 81 years, and women to 85 years. Many retirees will need to plan for a retirement that lasts 20-30 years.

If you’ve done your calculations and concluded that you won’t have enough to achieve your retirement dreams, consider how much time you have to boost your superannuation or savings.

It’s also important to note that you can still have a great retirement, even if it’s not considered to be in the top range of ‘comfortable’.

If you want to create a stronger retirement fund, or you want help in managing the process of budgeting and planning, you can speak with our retirement advisers about getting a financial plan for retirement. Call us on 07 3852 4114 or send us an enquiry to find out if financial advice would be a good option for you. We’d love to help you navigate the path to a secure and fulfilling retirement.

Next, read How to Fund Your Retirement to understand retirement income streams.